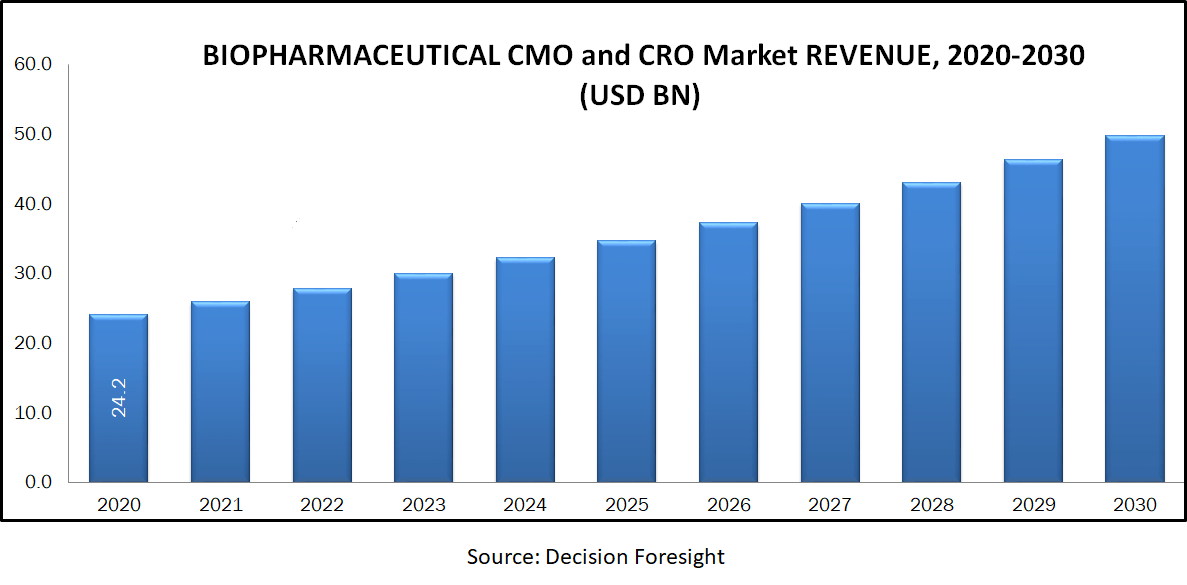

Biopharmaceutical CMO and CRO Market accounted 24.2 billion USD in 2020 and is expected to reach 49.8 billion USD by 2030 with a CAGR of 7.5% approximately during the forecast period.A contract research organization (CRO) is a company that provides services to the pharmaceutical and biotechnology industries. These companies collaborate with various other companies to organize and conduct clinical trials in order to test the new molecule before gaining approval. Contract manufacturing organizations (CMO) provide manufacturing services, with volume capacities ranging from small amounts for pre-clinical R&D to larger volumes required for clinical trial purposes and commercialization. Presently, biopharmaceutical companies are outsourcing their resources and taking capital-intensive steps. The market is significantly driven by the growing interest of conventional drug makers in biological therapeutics. Currently, outsourcing has become a cost-saving strategy for small to medium sized biomanufacturers, as it helps them to eliminate the need for establishing expensive specialized facilities or hiring and training personnel.

Market Segmentation:

On the basis of source type, the biopharmaceutical CMO and CRO market can be bifurcated into mammalian and non-mammalian. Based on service type, the market can be segmented into two parts – contract manufacturing and contract research. The contract manufacturing segment includes process development, fill & finish operations, analytical & QC studies, and packaging, whereas the contract research segment includes oncology, inflammation & immunology, cardiology, neuroscience, and others. According to product type, the biopharmaceutical CMO and CRO market can be classified into Biologics and Biosimilars. Biologics can be further classified into monoclonal antibodies, recombinant proteins, vaccines, antisense, RNAi, molecular therapy, and others. Geographically, the global biopharmaceutical CMO and CRO market can be broadly divided into mainly North America, Europe, Asia Pacific, and RoW.

Market Dynamics and Factors:

The decline in R&D productivity and augmented development costs have attributed to high pressure on biopharmaceutical manufacturers regarding short-term earnings and profit margins. This, in turn, has created lucrative opportunities for the Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs) to propel their business operations. Robustness of venture capital investments is one of the major factors that has created growth opportunities for CMOs. Venture capital funds are considered more dependable than public equity. Increasing availability of venture capital funds for life sciences is anticipated to further boost the growth of CMOs. Furthermore, the growing demand for biosimilars and biologics is expected to provide significant growth opportunities for the CMO and CRO market across the globe during the forecast period. However, the CMOs and CROs are facing competition from the in-house departments of many key pharmaceutical and biotechnology companies which is a major restraining factor. For instance, some major pharmaceutical companies such as Novartis announced to keep its biomanufacturing process in-house.

Geographic Analysis:

North America is expected to dominate the global biopharmaceutical CMO and CRO market in terms of market share during the forecast period. A substantial number of approved products in the U.S. are being manufactured by CMOs. Several small and mid-size biopharmaceutical companies lack the resources and budget to establish facilities with well-equipped resources. This, in turn, has augmented the inter-dependency between CMOs and the companies in the U.S., attributing to the dominance of the North American market. The Asia Pacific biopharmaceutical CMO & CRO market is anticipated to witness the fastest growth rate during the forecast period. The major factor for the rise in outsourcing in the Asian nations include cost-associated benefits, like, lower labour costs and operating costs, across the APAC region. India is expected to show significant growth due to the high volume of large molecule production within the country. The dearth of global regulatory symmetry for biosimilar approval has significantly boosted the APAC market for CMOs and CROs. For instance, as of 2016, there were around 50 approved biosimilars in India, out of which only 24 were approved in Europe and five in the U.S.

Competitive Scenario:

The key players operating in the global biopharmaceutical CMO and CRO market are –

Samsung BioLogics, Lonza, WuXi Biologics, JRS Pharma, Charles River Laboratories International Inc, Thermo Fisher Scientific Inc, Boehringer Ingelheim GmbH, FUJIFILM Diosynth Biotechnologies U.S.A., Inc., AbbVie Inc., Binex Co., Ltd., Rentschler Biotechnologie SE, ProBioGen AG.

Biopharmaceutical CMO & CRO Market Report Scope

| Report Attribute | Details |

| Analysis Period | 2020–2030 |

| Base Year | 2021 |

| Forecast Period | 2022–2030 |

| Market Size Estimation | Billion (USD) |

| Growth Rate (CAGR%) | 7.5% |

|

| By Source (Mammalian & Non-Mammalian), By Service (Contract Manufacturing {Process Development, Fill & Finish Operations, Analytical & Qc Studies, Packaging}, Contract Research {Oncology, Inflammation & Immunology, Cardiology, Neuroscience, And Others}), By Product Type (Biologics {Monoclonal Antibodies, Recombinant Proteins, Vaccines, Antisense, RNAi, & Molecular Therapy, And Others} And Biosimilars) |

| Geographical Segmentation | North America (U.S., Canada, Mexico) Europe (UK, Germany, Italy, France, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, Rest of APAC), South America (Brazil, Argentina, Rest of SA), MEA (UAE, Saudi Arabia, South Africa) |

| Key Companies Profiled | Samsung BioLogics, Lonza, WuXi Biologics, JRS Pharma, Charles River Laboratories International Inc, Thermo Fisher Scientific Inc, Boehringer Ingelheim GmbH, FUJIFILM Diosynth Biotechnologies U.S.A., Inc., AbbVie Inc., Binex Co., Ltd., Rentschler Biotechnologie SE, ProBioGen AG. |