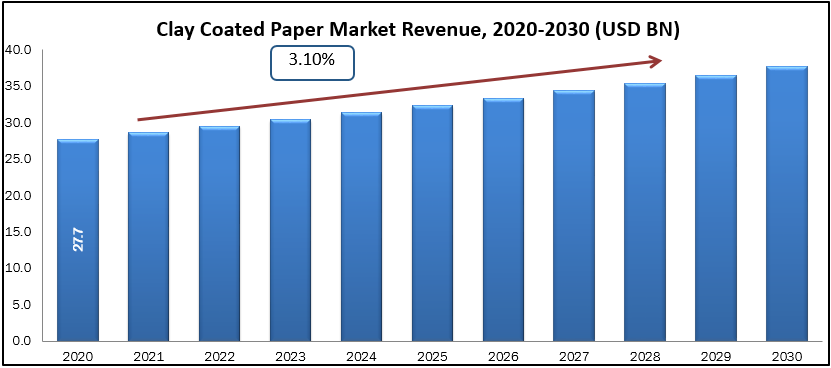

Clay Coated Paper Market size was valued at USD 27.7 billion in 2020 and is projected to reach USD 37.6 billion by 2030 growing with the CAGR of 3.1% during the forecast period 2020 to 2030. Clay Coated Paper is a form of coated paper in which one or both sides have been covered with refined clay. The clay fills the spaces between the paper's fibers, improving the finished paper's smoothness. Clay also enhances a paper's opacity, brightness, and ink receptivity, resulting in better print quality. A smooth clay coating is placed over a freesheet or ground wood base paper in coated papers. The base paper is created first, then coated in a "bath" of clay or while passing through a machine, with a blade and calendar rollers smoothing off the coating. The clay coating can account for up to half of the paper's weight.

Kaolinite, calcium carbonate, bentonite, and talc are some of the minerals that may be used to coat paper for high-quality printing in the packaging sector and magazines. Synthetic viscosities, such as styrene-butadiene latexes, and natural organic binders, such as starch, are used to adhere the chalk or china clay to the paper. Chemical additives such as dispersants, resins, or polythene may be included in the coating formulation to offer the paper water resistance and wet strength, as well as UV protection. The rising popularity of e-commerce and home delivery systems is the major driver driving market development. Coated papers are becoming more popular as a result of their diverse textures and finishing quality, which provides a range of packaging alternatives. Furthermore, the growing need for flexible packaging in industries such as food and beverage helps to propel the market forwards. As people become more aware of the negative impacts of plastic packaging on food items, there is a greater need for bio-based and biodegradable packaging materials.

Market Segmentation:

- Material Insights

Clay coating market can be segmented based on clay mineral as Kaolinite, calcium carbonate, bentonite, and talc. Kaolin is the most common particulate material used in paper filling and coating. It enhances the look of the paper, which is defined by gloss, smoothness, brightness, and opacity, as well as its printability. Kaolin is also used to prolong the fiber in the paper. The purity, rheology, and particle geometry of the processed material are the properties of kaolin that have the greatest impact on paper quality. Iron oxide and titanium oxide minerals are the most harmful contaminants for kaolin's brightness. Particle size and particle size distribution determine the opacity, gloss, printability, and, to a lesser extent, brightness of paper given by coating and filling with kaolin. The strength of coated and filled paper decreases as the particle size decreases. An increase in coating void volume has a negative impact on strength in most cases.

- Application Insights

Clay coating market can be segmented based on the paper applications as up to Printing, Packaging & Labeling & Others. Flexible paper packaging solutions, as opposed to flexible plastics, are becoming increasingly popular in the packaging sector throughout the world, allowing way for coated paper. For packaging wheat, sugar, medicinal goods, processed meats, frozen meals, cigarette bundles, and other retail products, the FMCG sector is one of the major end-users of this product. The e-commerce industry's rapid expansion has opened the way for attractive and premium packaging, expanding the coated paper market's reach. The growing popularity of home delivery services, along with the growing presence of online retailers, has boosted the use of coated paper in packaging. This application has suffered as a result of increasing digitization, and it is now at risk of becoming saturated. The usage of coated paper in money, security papers, and check books, however, is expected to keep the category growing steadily during the projected period. Furthermore, consistent use of this product as brochures and product manuals for cellphones, laptops, and other electronic devices will maintain demand.

Geographical Analysis

In terms of volume, North America held the greatest share, and the market is largely driven by the United States' high rate of production. The region is also home to a number of major firms, resulting in large-scale coated paper manufacturing. Because corporate profit is such a big part of the US economy, firms rely a lot on paper products, which means there's a lot of room for development. Consumers in the United States are still concerned about the influence of packaging on the environment in particular. Consumers are ready to pay more for green, but if more of them were available and correctly labelled, they would buy more sustainably packaged items.

In Europe, The use of clay-coated paper is decreasing as a result of digitalization. Growth in packaging and hygiene papers, on the other hand, balances this out. The development of innovative bio-based goods opens up a world of possibilities for the industry. Specialty and paperboard papers, as well as industrial packaging papers, are projected to rise rapidly in developed countries such as Europe during the next five years, owing to changing lifestyles and rising wealth, as well as sluggish e-commerce development, as well as bio-based fuels and chemicals and conventional wood-based products, thanks to new business models.

In Asia Pacific, Due to increased production and consumption of coated paper in the worldwide market, Asia Pacific is projected to expand steadily. Because the area is home to some of the world's top paper consumers, such as India and China, the product's potential has grown across sectors. Furthermore, the region's expanding ecommerce industry has boosted product demand for printing and packaging. Product utilization in advertising and print media has potential for improvement as well. Coated paper is mostly consumed in Asia-Pacific by China, India, Japan, South Korea, and Indonesia. Coated paper is in great demand due to its expanded use in a variety of sectors, including printing and packaging. Coated paper is mostly consumed in China, and demand for coated paper in Asia-Pacific is projected to rise throughout the projection period.

The paper and paperboard market in the Middle East and Africa is somewhat fragmented. Due to comparable portfolio offers, it comprises of multiple large companies, posing a danger of replacements. Vendors with a focus on sustainability are expanding their client base and gaining market share by improving their product range and utilizing strategic collaboration efforts and acquisitions as a competitive advantage. Furthermore, nations around the region, including the United Arab Emirates, are seeing significant advancements in sustainability, with consumers and businesses increasingly demanding zero waste, boosting market growth. Additionally, the increasing incomes of consumers led them to opt for premium products, thereby, raising the demand for premium packaging for consumer products, such as cosmetics and skincare, together with the presence of major supermarkets, such as remains the main channel for the distribution of premium products across the region.

Key Companies Insights

In June 2021, Sappi Limited, a major global producer of strong everyday materials derived from wood fiber-based renewable resources, today announced a collaboration with Eco Vadis, a global pioneer in third-party assessments of company sustainability performance. The two businesses will work together to analyze Sappi's suppliers' sustainability performance through proactive ratings and assessments using Eco Vadis' approach. The new collaboration will encourage ethical corporate practices that are in line with the United Nations Sustainable Development Goals.

- Ahlstrom Munksj

- Globus International

- Sappi Limited

- Spoton Coatings

- A.J. Schrafel Pape

- Asia Pulp & Paper

- Verso Corporation

- UPM

- Resolute Forest Products

- Packaging Corporation of America

- Dunn Paper Company

- Stora Enso OYJ

- Nippon Paper Industries

- Oji Holdings Corporation

Clay Coated Paper Market Report Scope

| Report Attribute | Details |

| Market size value in 2020 | USD 27.7 billion |

| Revenue forecast in 2030 | USD 37.6 billion |

| Growth Rate | CAGR of 3.1% from 2021 to 2028 |

| Base year for estimation | 2019 |

| Historical data | 2016 - 2019 |

| Forecast period | 2020 - 2030 |

| Quantitative units | Revenue in USD million and CAGR from 2020 to 2030 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Material Insights (Kaolinite, calcium carbonate, bentonite, and talc), By Application Insights (Printing, Packaging & Labeling & Others) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; South Korea; Brazil; Mexico; South Africa; Saudi Arabia; UAE |

| Key companies profiled | Ahlstrom Munksj, Globus International, Sappi Limited, Spoton Coatings, A.J. Schrafel Pape, Asia Pulp & Paper, Verso Corporation, UPM, Resolute Forest Products, Packaging Corporation of America |