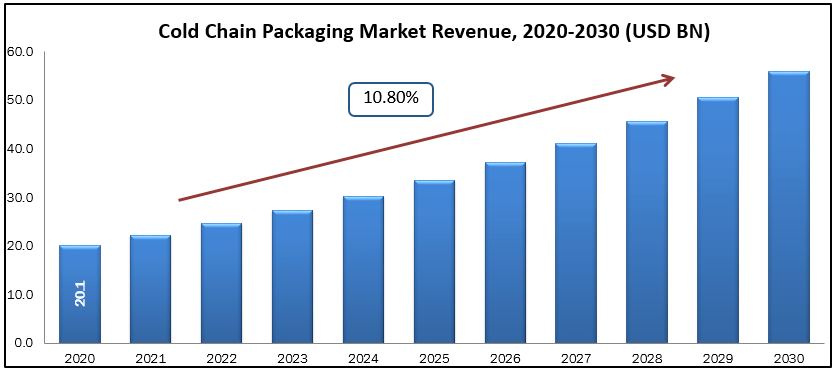

Cold Chain Packaging Market size was valued at USD 20.08 billion in 2020 and is projected to reach USD 56 billion by 2030 growing with the CAGR of 10.8% during the forecast period 2020 to 2030. The term "cold chain packing" refers to a method of packaging and delivering goods that maintains a constant temperature from manufacturing to ultimate destination. Although it may appear that cold chain packaging is a difficult undertaking best saved for extremely temperature sensitive items, the fact is that for many types of products, the advantages exceed the expenses. The appropriate cold chain packaging may make temperature regulated shipment simple and less vulnerable.

The rising incidence of chronic illnesses has raised demand for complicated biological-based medications, vaccines, hormones, and complex proteins in recent years. The expanding commerce of medicines, vaccines, and other medical products is driving the expansion of the cold chain packaging industry. Pharmaceutical firms are spending substantially in cold packing methods to keep medicines and vaccines as effective as possible. Aside from storage, the shipments need cold chain improvements for optimal temperature transit. In the healthcare packaging industry, the need for cold chain packaging has skyrocketed. Cold chain packaging is used in the supply and logistics of biopharmaceuticals, clinical trials, and vaccinations, among other things. The significant rise of the cold chain packaging industry is attributable to an increase in the sales of medical items that need cold chain logistics.

Market Segmentation:

Product Insights

On the basis of Product, Cold Chain Packaging market can be segmented as ,Pallet Shippers, Insulated Containers, Foam Bricks, Gel Packs, Protective Packaging (Foams Sheets, etc.), Phase Change Cold Storage Products .The market was dominated by the insulated container and boxes category, which accounted for more than half of the market share. This high share is due to the growing need for reusable insulated containers in a variety of industries, including food processing, fruits, and vegetables. The section is further subdivided into big, medium, small, very tiny, and petite payload sizes. The market has also been divided into crates, cold packs, labels, and temperature-controlled pallet shippers based on the product. Crates are further subdivided into uses such as dairy, medicinal, fisheries, and horticulture.The cold packs market is expected to develop at the fastest rate. Over the projection period, the temperature-controlled pallet shipper sector is anticipated to develop at a high compound annual growth rate. Pallet shippers made of low-density polythene (LDPE), polyurethane (PUR), and expanded polystyrene (EPS) are available on the market.

Material Insights

On the basis of material, the Cold Chain Packaging market is segmented Expanded Polystyrene (EPS), Polyurethane rigid foam (PUR), Vacuum Insulated Panel (VIP), Cryogenic Tanks& Other Materials Type. TIn the present market, polymer is the most commonly used material for cold chain production. Polymer barrier resins are extremely beneficial in maintaining freshness and increasing the shelf-lives of food and drinks. Furthermore, they are light-weight, cost-effective, and non-reactive with food, drinks, pharmaceutical, and cosmetic items within, making them in great demand by a wide range of end-use sectors.The insulating materials sector accounted for the lion's share of the cold chain packaging market's sales. The insulating material category is further subdivided into cryogenic tanks, PUR, Vacuum Insulated Panel (VIP), EPS, and others.Other products include hard-cased thermal boxes, insulting pouches, and active thermal systems. EPS has maintained its dominant position and is likely to maintain its iron grip on the insulating materials market over the projection period.The refrigerant industry includes hydrocarbons, fluorocarbons, and organics (CO2 and ammonia).

End Use Insights

On the basis of End use, the Cold Chain Packaging market is divided into Food & Beverages, Fruits & Vegetables, Fruit & Pulp Concentrates, Dairy Products, pharmaceutical sand Bakery & Confectionaries. During the projected period, the fruits and vegetables category is expected to grow. Fresh fruits and vegetables must be properly chilled to maintain their freshness until they reach the client. A well-organized packaging system may help food processing firms conduct their operations more effectively. Throughout the projection period, the processed food industry is expected to have the greatest CAGR. The increase can be attributed to increased global consumption of processed goods such as chocolate bars, canned beans, jams and pickles, canned meat, and other food products.Pharmaceutical manufacturing necessitates the use of cold chain packaging solutions, as firms seek effective ways to store and protect vaccines, medications, blood samples, and other temperature-sensitive medical items.

Geographical Analysis

North America is one of the largest producers of these solutions in the world. The region held the second-largest share in the global market in 2020. The United States dominates the regional market on account of its technological advancement and well-established supply chains. The country's enormous region and lopsided populace conveyance make the use of cold bundling much more significant in moving food items and drug medications to far off areas. According to the US Department of Agricultural (USDA), the food, farming, and united ventures contributed US$ 1.109 trillion to the US gross domestic product (GDP) in 2019, accounting for 5.2 percent of the total. According to the research, the food and beverage sector expanded to US$ 500 billion in 2019 and is expected to grow rapidly in the future years. The United States is expected to continue its dominance during the projection period as a result of these driving forces.Canada is another important part of the North American cold chain packaging industry, and it is expected to develop steadily through 2030. Rising demand in the food, beverage, and pharmaceutical industries is driving growth in Canada.

In Europe, Because of economic development and expansion, Central and Eastern European countries are projected to give more growth prospects than Western ones. Germany imports a considerable amount of chilled and frozen fruits, vegetables, meat, fish, and milk products. The packaged food business is prospering in the country as a result of increased consumer health awareness and nutritious consumption. Furthermore, Germany is recognized as the European food and beverage industry leader, which substantially promotes the region's cold packaging business growth. France has emerged as another attractive European market for cold chain packaging. Rising demand from the food, beverage, cosmetics, and pharmaceutical industries is projected to drive French development.

In the Asia Pacific, constantly increasing demand from the food and beverage industries has kept South Korea in the limelight for cold chain packaging producers. According to a research by South Korea Agriculture and Agri-Food Canada (AAFC), the South Korean foodservice sector is anticipated to reach US$ 104.7 billion by 2023, expanding at a CAGR of 3.6 percent since 2020. According to the research, South Korea has the largest foodservice market among the four ‘big' economies: South Korea, Hong Kong, Taiwan, and Singapore, with a population of 51.6 million. Developing economies such as India, China, ASEAN, and others are anticipated to see significant increases in expenditures for the construction of cold storage infrastructure, which is predicted to fuel the overall expansion in the Asia-Pacific cold chain packaging market.

In Middle East & Africa Because of their infrastructure and high-income-generating enterprises, the GCC nations account for the majority of the market in the Middle East. The food sector has a significant requirement for cold storage packaging due to regional temperature patterns. It's used to keep frozen vegetables, fruits, and other agricultural products warm. Leading cold chain organizations in Africa, such as the Global Cold Chain Alliance, are collaborating with local firms to create and enhance cold chain logistics. The Global Cold Chain Alliance's South Africa regional office successfully conducted a Virtual Cold Store Operations Short Course in August 2020, with students from South Africa, Ghana, Namibia, Kenya, and Nigeria participating. During the projection period, such initiatives are expected to generate potential demand in African emerging nations.

Key Companies Insights

In Nov 2020, Sonoco ThermoSafe, a division of Sonoco (NYSE:SON) and the world's leading producer of temperature assurance packaging for life sciences and healthcare, has launched its new EOSTM range of completely kerbside recyclable temperature regulated packaging in the United States. EOS was developed to provide concerned life science and perishable clients with a really kerbside recyclable solution from a reputable source. Several rival insulated packaging materials claim kerbside recyclability, but employ inner pellets, panels, and liner coatings that cannot be separated or sorted and therefore become unrecyclable in their whole at Material Recycling Facilities.

- Sonoco ThermoSafe

- Sofrigam SAS

- Cryopak Industries Inc.

- CSafe Global, LLC

- Softbox Systems Ltd.

- TOWER Cold Chain Solutions

- Pelican Products, Inc.

- Creopak

- DGP Intelsius LLC

- TemperPack Technologies, Inc.

- Tempack Packaging Solutions SL.

- Sealed Air Corporation

- Intelsius

- Nordic Cold Chain Solutions

- Tempack

Cold chain packaging Market Report Scope

| Report Attribute | Details |

| Market size value in 2020 | USD 20.8 billion |

| Revenue forecast in 2030 | USD 56 billion |

| Growth Rate | CAGR of 10.8% from 2021 to 2028 |

| Base year for estimation | 2019 |

| Historical data | 2016 - 2019 |

| Forecast period | 2020 - 2030 |

| Quantitative units | Revenue in USD million and CAGR from 2020 to 2030 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Product Insights (Pallet Shippers, Insulated Containers, Foam Bricks, Gel Packs, Protective Packaging (Foams Sheets, etc.), Phase Change Cold Storage Products ), By Material Insights (segmented Expanded Polystyrene (EPS), Polyurethane rigid foam (PUR), Vacuum Insulated Panel (VIP), Cryogenic Tanks& Other Materials Type), By End Use Insights (Food & Beverages, Fruits & Vegetables, Fruit & Pulp Concentrates, Dairy Products, pharmaceutical sand Bakery & Confectionaries) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; South Korea; Brazil; Mexico; South Africa; Saudi Arabia; UAE |

| Key companies profiled | Creopak, DGP Intelsius LLC, TemperPack Technologies, Inc., Tempack Packaging Solutions SL., Sealed Air Corporation,Intelsius,Nordic Cold Chain Solutions |