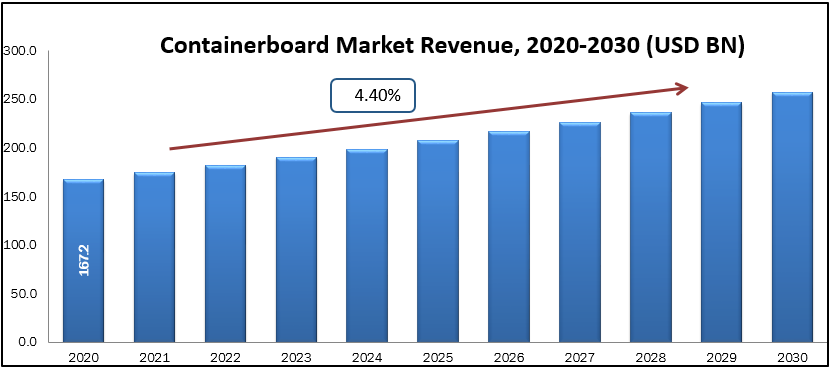

Containerboard Market size was valued at USD 167.2 billion in 2020 and is projected to reach USD 257.2 billion by 2030 growing with the CAGR of 4.4% during the forecast period 2020 to 2030. Containerboard is commonly referred to as cardboard, but it is also known as containerboard, corrugated containerboard, and corrugated fiberboard. In the United States, containerboard is the most recycled packaging material.Containerboard, commonly known as CCM or corrugated case material, is a form of paperboard made specifically for corrugated board production. Both linerboard and corrugating medium, the two forms of paper that make up corrugated board, are included in the phrase. Containerboard is brown in colour since it is mostly constructed of natural unbleached wood fibers, however the hue varies based on the kind of wood, pulping method, recycling rate, and impurities content. On the top ply of the linerboard that goes outside the box, white bleached pulp or coating is utilised for specific boxes that need good presentation. The containerboard market would profit from the growing demand for lightweight packaging materials, which would help to enhance supply chain efficiency by lowering shipping costs and ensuring product safety. The use of corrugated boxes in specialized products to protect things from external stress is also encouraging growth, thanks to the rapid development of the e-commerce business. These sheets are used to produce cardboards for packing pharmaceuticals, food, chemicals, and engineering items.

Market Segmentation:

Product Insights

The market is divided into three categories: linerboard, corrugating medium, and white tops. There are two types of linerboard: kraft liners and test liners. During the projection period, kraft liners are expected to account for the majority of the market share due to their high tensile strength and widespread use in the manufacture of paper sacks.Kraft Liner is a form of packing paper or paperboard that has at least 80% virgin fibres produced by chemical sulphate or soda procedures. It's made of virgin fabric and has a strong tearing, stress, and punching resistance. Because of these characteristics, it's suitable for making packaging with complicated structures and requiring greater degrees of resistance. It is also well suited to damp settings.Test liners, on the other hand, are expected to grow significantly due to their wide range of applications in consumer durables packaging, such as processed food, meat products, and home & personal care, as well as their role in reducing carbon emissions, which is driving the segment's growth over the forecast period.

Material Insights

On the basis of material market is divided into two categories based on material: virgin and recycled. Recycled containerboard has a significant market share in the material sector. The growing desire of manufacturers for recyclable materials in consumer products has raised demand for recycled resources. The materials are easily recyclable and do not pose any environmental risks. Governments in both rich and emerging nations are starting new programmes to recycle more and more paper packaging goods in order to minimise the usage of virgin material, which needs vast amounts of resources to manufacture. The global push for recyclability in the containerboard industry opens up huge potential for recycling firms all over the world. Recycled fibre is also seen to provide a significant economic benefit in the manufacturing of corrugated boxes. When compared to virgin fibre, corrugated boxes take less energy and resources to produce. The market has also been fueled by the food and beverage industry's increased need for environmentally friendly and sustainable packaging solutions. Furthermore, because they are cost-effective and conform with government environmental laws, demand for recycled ones is projected to rise, helping the entire market.

End Use Insights

The market is divided into five categories based on the application type: fast-moving consumer products, industrial, food and beverages, agricultural, and fruits & vegetables packaging. Processed foods, home & personal care, meat, medicines, fats & oils, dairy & alternatives, and alcohol & beverages are the different categories of fast-moving consumer products. Because of its widespread use in protecting consumables from contamination and tempering, the processed food application is expected to have the biggest share of the market throughout the projection period. To keep their flavour and texture, many items require food stability.Over the projection period, the pharmaceutical industry is expected to develop significantly. These products are used to maintain a sterile environment, fragile product protection, and stacking efficiency, as well as to protect pharmaceuticals from radiations that might cause changes in chemical compositions and loss of medicinal value, boosting market expansion during the projection period.

Geographical Analysis

In North America, the United States is a significant supplier of containerboard, particularly corrugated containers and kraftliners, across the world. In comparison to other locations, the cost of materials and production in the country is lower. The country's concern for long-term growth is also a factor in the country's high containerboard production. Vendors are also motivated to expand their investments in the market researched as knowledge and activities surrounding the recycling process grow. There are 20% more trees in the country today than there were in last few decades.

Last year, Europe's containerboard demand increased, and with prices high and paper supplies limited, several firms throughout Europe went forwards with statements about future capacity increases over the next five years. This is a common occurrence in commodities markets towards the peak of the business cycle—and we all know what occurs next. It's worth noting that this is in striking contrast to what happened in Europe less than a decade ago.The majority of the emphasis has been focused on Italy. Between now and 2023, at least six initiatives aimed at increasing capacity are in the works, with all of them concentrating on recycled containerboard.

Asia Pacific gained a large market revenue share, with a high CAGR. Market expansion would be aided by rising demand for insulated packaging from industries such as food and beverage. During the projected years, an increase in demand for insulated packaging for the packaging of food goods from E-commerce channels will be another market driving factor. Protective packaging market growth has been fueled by rising online food ordering in key nations such as China, Japan, India, and other Asia Pacific countries. Protective packaging is essential for e-commerce meal delivery and grocery delivery, since it ensures that products arrive securely. The increasing use of E-commerce for purchases in India, Japan, and China is a major driver driving market expansion in the Asia Pacific region. Because of the increased interest in access, the E-commerce industry in India and China, for example, is steadily developing.

In Middle East & Africa ,the increase in environmental awareness among populations, demand for sustainable packaging solutions, demand for convenient packaging (offset by new restrictions on single-use in some countries), growing e-commerce market, and rise in demand for electronic goods and home and personal care products are all contributing to the accelerated growth of the containerboard packaging market in the United Arab Emirates. Many global players have begun to establish themselves in the MENA area in order to fulfil the region's rising demands. Planatol Middle East FZE, a subsidiary of Germany's Planatol Group, was recently created in the United Arab Emirates with the goal of capturing a market share of at least 20% in the containerboard packaging and perfect binding adhesives and glue categories.

Key Companies Insights

Companies are engaged in various strategies, such as mergers &acquisitions, product launches, partnerships, and joint ventures to gain a greater market share. In Feb 2020, Mondi, a major worldwide packaging and paper producer, has teamed up with Cartro, a leading corrugated packaging provider in Mexico, to launch a new avocado box that is designed to be sustainable. Mondi's high-quality portfolio of paper grades, including "FirstClassFlutes by Mondi" and ProVantage Kraftliner Aqua, were used to create a brand-new corrugated box that stands out from the crowd. Mondi's paper grades have high edge crush test (ECT) and box compression test (BCT) values, allowing for good strength in humid circumstances while reducing weight by 18%.

- International Paper

- Mondi

- SCA

- Westrock

- Stora Enso

- Sonoco Products

- SCG PACKAGING PUBLIC COMPANY LIMITED

- DS Smith

- Lee & Man Paper Manufacturing Ltd.

- Smurfit Kappa

- International Paper

- Oji Fibre Solutions (NZ) Ltd.

- WestRock Company

- Rengo Co., Ltd.

- Georgia-Pacific LLC

- Hamburger Containerboard

- Nine Dragons Paper (Holdings) Limited

Containerboard Market Report Scope

| Report Attribute | Details |

| Market size value in 2020 | USD 167.2billion |

| Revenue forecast in 2030 | USD 257.2billion |

| Growth Rate | CAGR of 4.4% from 2021 to 2030 |

| Base year for estimation | 2019 |

| Historical data | 2016 - 2019 |

| Forecast period | 2020 - 2030 |

| Quantitative units | Revenue in USD million and CAGR from 2020 to 2030 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Product (Linerboard, Corrugating Medium, White tops, Others), By Material (Virgin, Recycled ), By End Use (Fast-Moving Consumer Products, Industrial, Food and beverages, Agricultural, Fruits & vegetables packaging, Others) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; South Korea; Brazil; Mexico; South Africa; Saudi Arabia; UAE |

| Key companies profiled | International Paper, Mondi, SCA, Westrock, Stora Enso, Sonoco Products, SCG PACKAGING PUBLIC COMPANY LIMITED, DS Smith, Lee & Man Paper Manufacturing Ltd., Smurfit Kappa, International Paper |