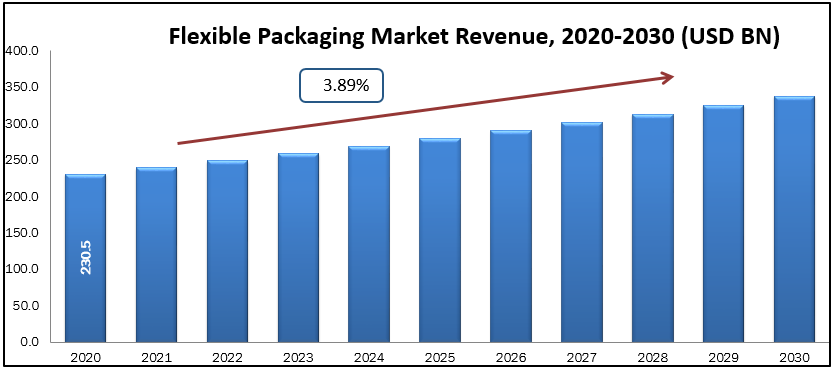

Flexible Packaging Market size was valued at USD 230.49 billion in 2020 and is projected to reach USD 337.6 billion by 2030 growing with the CAGR of 3.89% during the forecast period 2020 to 2030. Flexible packaging is a method of packaging items that uses non-rigid materials, allowing for more cost-effective and customized alternatives. It is a relatively recent technology in the packaging business that has risen in popularity due to its great efficiency and low cost. This packaging method creates pouches, bags, and other malleable product containers using a range of flexible materials such as foil, plastic, and paper. Flexible packaging is especially beneficial in sectors requiring adaptable packaging, such as food and beverage, personal care, and pharmaceutical.

Flexible packaging is available in a wide range of materials, forms, and sizes, and is generally manufactured in either formed or unformed formats. Formed goods are pre-shaped and may be filled and sealed in-house, whereas unformed items are generally delivered on a roll and sent to co-packers for shaping and filling.The growing demand for snack and convenience meals in tiny or single-serving quantities propels the flexible packaging industry forwards. The packaging industry is shifting towards flexible packaging due to its numerous energy and environmental benefits. Flexible packaging combines the benefits of plastic, paper, and aluminum foil without losing the product's freshness, barrier protection, durability, printability, or ease of use. With these benefits of flexible packaging, the market will expand throughout the projected period.

Market Segmentation:

- Material Insights

Flexible packaging market can be segmented based on material as Paperboard, Aluminum, plastic & Other. Flexible packaging market can be segmented based on the paper applications as up to Printing, Packaging & Labeling & Others.Flexible paper packaging solutions, as opposed to flexible plastics, are becoming increasingly popular in the packaging sector throughout the world, allowing way for coated paper. For packaging wheat, sugar, medicinal goods, processed meats, frozen meals, cigarette bundles, and other retail products, the FMCG sector is one of the major end-users of this product. The e-commerce industry's rapid expansion has opened the way for attractive and premium packaging, expanding the coated paper market's reach. The growing popularity of home delivery services, along with the growing presence of online retailers, has boosted the use of coated paper in packaging. This application has suffered as a result of increasing digitization, and it is now at risk of becoming saturated. The usage of coated paper in money, security papers, and check books, however, is expected to keep the category growing steadily during the projected period. Furthermore, consistent use of this product as brochures and product manuals for cellphones, laptops, and other electronic devices will maintain demand.

- End Use Insights

Based on the application, food & beverages holds the largest segment, Based on the application, food & beverages holds the largest segment, accounting for most of the Flexible Packaging market share. Other major application includes pharmaceuticals, cosmetics and other Until recently, the Food and Beverage and Pharmaceutical industries have dominated the flexible packaging industry, accounting for more than half of total demand, and will continue to have the biggest effect on growth. Proper packing allows for more efficient and successful delivery of food and pharmaceutical items. Furthermore, rising demand for advance packaging in emerging markets due to increased consumption of packaged food items, as well as rising health and nutrition concerns, promotes the expansion of advance packaging in the food and beverage sector.

Geographical Analysis

In terms of volume, North America held the greatest share, and the market is largely driven by the United States' high rate of production. Flexible are widely utilized in the e-commerce business to pack items throughout the shipping phase from a distribution center to a customer. Growing e-commerce sales in the United States will increase demand for flexible plastic packaging in the nation. Flexible packaging solutions are being used as a robust, portable, and lightweight packaging alternative in fast serve restaurants and single serve beverage servings. Growing fast food restaurant franchises in the United States will assist the country's growth. United States is home to some of the world's largest e-commerce firms, making it a profitable market for flexible plastic packaging producers. Furthermore, key end use sectors in the United States such as personal care, healthcare, pharmaceuticals, and industrial packaging are projected to drive demand growth during the projection period.

The growing need for fast-moving goods, as well as the thriving e-commerce industry, will drive up demand for flexible plastic packaging solutions in Europe. The growing need for general barrier, long life, and durable plastics in the healthcare industry is projected to support regional market expansion. Rising international pressure to eliminate non-biodegradable plastics, as well as severe government laws on plastic use, will give impetus for the development of biodegradable plastic packaging solutions and bio-plastic produced from sustainable sources. Because of its low cost and eco-friendliness, flexible plastic packaging is gaining appeal in the food, pharmaceutical, and personal care industries. Over the projection period, the ban on single-use plastics and increased government investment in upgrading recycling facilities in Europe are projected to produce a considerable demand for flexible packaging goods.

In Asia Pacific, Due to increased production and consumption of coated paper in the worldwide market, Asia Pacific is projected to expand steadily. Because the area is home to some of the world's top paper consumers, such as India and China, the product's potential has grown across sectors. Furthermore, the region's expanding ecommerce industry has boosted product demand for printing and packaging. Product utilization in advertising and print media has potential for improvement as well. Coated paper is mostly consumed in Asia-Pacific by China, India, Japan, South Korea, and Indonesia. Coated paper is in great demand due to its expanded use in a variety of sectors, including printing and packaging. Coated paper is mostly consumed in China, and demand for coated paper in Asia-Pacific is projected to rise throughout the projection period.

In Middle East The market for flexible packaging items in the region is typically driven by millennial clients, who have a strong affinity for single-serving and on-the-go food and beverage delicacies. Flexible packaging is a popular alternative for packing these items since they are typically designed to be sturdy, portable, and lightweight. Flexible packaging demand from the region's food and beverage industry is expected to be governed by the region's fastest growing snack foods, both in terms of processed foods and fresh goods. Furthermore, nations around the region, including the United Arab Emirates, are seeing significant advancements in sustainability, with consumers and businesses increasingly demanding zero waste, boosting market growth. Additionally, the increasing incomes of consumers led them to opt for premium products, thereby, raising the demand for premium packaging for consumer products, such as cosmetics and skincare, together with the presence of major supermarkets, remains the main channel for the distribution of premium products across the region.

Key Companies Insights

In June 2021, Mondi creates an useable bag prototype that contains 20% post-consumer trash, bringing flexible packaging one step closer to a circular economy. Project Proof, a Pioneer Project sponsored by the Ellen MacArthur Foundation, was headed by Mondi Group, a global leader in packaging and paper (EMF). The research developed a proof-of-concept prototype flexible plastic pouch containing at least 20% post-consumer plastic trash derived from mixed household waste.

- AR Packaging Group AB

- Mondi Group

- DS Smith Plc

- CCL Industries Inc.

- Uflex Ltd.

- Winpak Ltd.

- Rengo Co. Ltd.

- Transcontinental Inc.

- Verso Corporation

- UPM

- Bryce Corporation

- Printpack, Inc.

- Parkside Flexibles (Europe) Limited

- Lindopharm GmbH

- Flair Flexible Packaging Corporation

- Packaging Corporation of America

Flexible packaging Market Report Scope

| Report Attribute | Details |

| Market size value in 2020 | USD 230.49 billion |

| Revenue forecast in 2030 | USD 337.6 billion |

| Growth Rate | CAGR of 3.89% from 2021 to 2028 |

| Base year for estimation | 2019 |

| Historical data | 2016 - 2019 |

| Forecast period | 2020 - 2030 |

| Quantitative units | Revenue in USD million and CAGR from 2020 to 2030 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Material Insights (Paperboard, Aluminum, plastic & Other), By End Use Insights (pharmaceuticals, cosmetics and other) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; South Korea; Brazil; Mexico; South Africa; Saudi Arabia; UAE |

| Key companies profiled | Sappi Limited, AR Packaging Group AB, Mondi Group, DS Smith Plc, CCL Industries Inc., Uflex Ltd., Winpak Ltd, Rengo Co. Ltd., Transcontinental Inc., Verso Corporation |