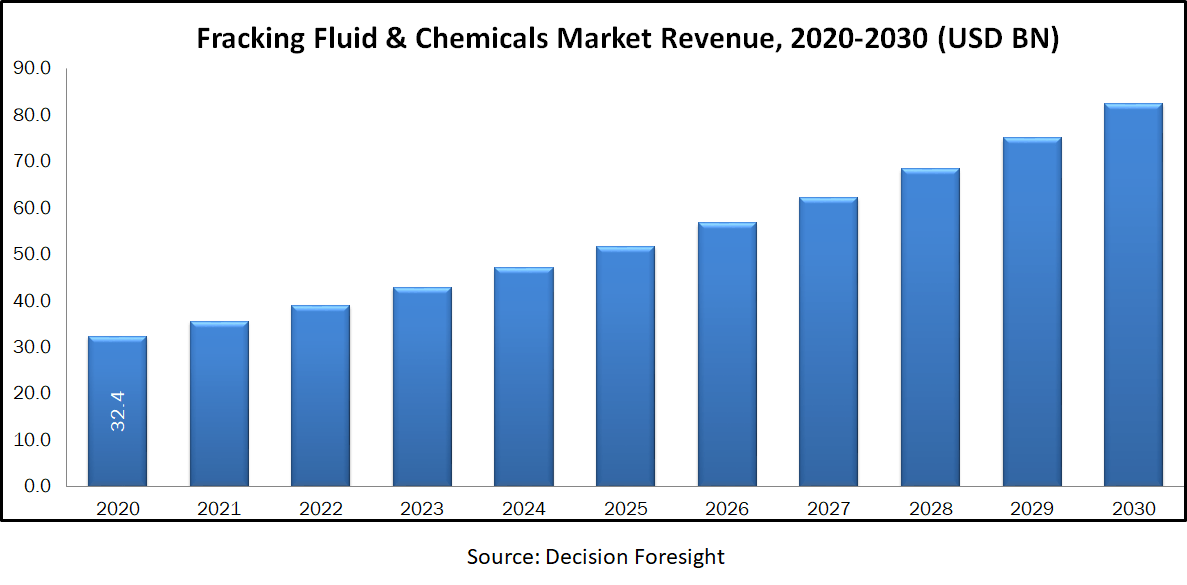

Fracking Fluid & Chemicals Market held USD 32.4 billion in 2020 and is to grow with a CAGR of 9.8% from 2020-2030. Fracking fluids and chemicals are chemical substances used in hydraulic drilling. This hydraulic fracturing has provided greater access to cleaner resources. Fracturing fluids and chemicals are used to reduce friction pressure loss, to create large fracture by creating adequate pressure drop, to maintain good stability, etc. These fluids and chemicals have multiple uses in hydraulic fracking, such as preventing corrosion, dissolving minerals, stabilizing the substance, preventing deposition of the scale and preserving fluid viscosity among others.

Market Dynamics and Factors:

The change in trend for horizontal drilling of wells is expected to drive global fracking fluids and chemicals market growth. There has been a significant rise in horizontal fracking activity in the recent past. This operation involves a comparatively greater amount of chemical and fracking fluids. As such, there has been a steady increase in demand for drilling fluids and chemical agents. Over the forecast period the fracking fluid & chemicals market size is expected to continue. The rising demand for resources requires further exploration, which in turn contributes to increased fracking fluids and chemicals market demand. Firm environmental regulations and substitutes to fracking fluids are thus major factors which are expected to restrict the fracking fluids and chemicals demand during the forecast era. The decision to form fracking fluids to be used also depends on geological condition-based technical difficulty, cost, and environmental impact. Water-based fluid is commonly used fracking fluids due to its varied applications and cost effectiveness, However, gelled oil-based fluids are projected to experience an upward trend, with growing environmental issues and harm to the ecosystem.

Market Segmentation:

Based on the type of basis fluids, the global fracking fluid & chemicals market is segmented into water-based, foam-based gelled oil-based. On the basis of function type, the market is classified into acid, biocide, surfactant, cross linker, gelling agent, scale inhibitor, iron control, clay control/stabilizer, breaker, corrosion inhibitor, friction reducer. Geographic bifurcation of global fracking fluid & chemicals market comprises regions North America, Europe, Asia-Pacific, and RoW.

Geographic Analysis:

Due to growing oil & gas exploration activities, steady economic development and favorable government policies, North America contributes the largest fracking fluid & chemicals market share in the world economy. Countries like Denmark, Germany and France have been showing possible development in the demand for drilling fluids and chemicals. Acceptance in Europe and the North American area of new exploration techniques, such as horizontal drilling, to extract oil and gas, stimulates the fracking fluids and chemicals size positively. The latest advances in discovering new, eco-friendly fracking chemicals are expected to fuel fracking fluids and chemicals market growth in the industry. Increasing environmentally friendly fracking fluids and chemicals market demand in emerging economies like the Asia-Pacific region would fuel fracking fluid & chemicals market growth.

Competitive Scenario:

The players involved in fracking fluid & chemicals industry are specialty chemical companies, drilling, and extraction service providers namely, Halliburton (U.S.), Schlumberger (U.S.), Baker Hughes (U.S.), DuPont (U.S.), AkzoNobel (Netherlands), BASF (Germany), and Ashland (U.S).

Fracking Fluid & Chemicals Market Report Scope

| Report Attribute | Details |

| Analysis Period | 2020–2030 |

| Base Year | 2021 |

| Forecast Period | 2022–2030 |

| Market Size Estimation | Billion (USD) |

| Growth Rate (CAGR%) | 9.8 % |

|

| by Basis Fluids (Water-Based, Foam-Based Gelled Oil-Based), Well Type Horizontal and Vertical), By Function Type (Acid, Surfactant, Biocide, Gelling Agent, Cross linker, Breaker, Scale Inhibitor, Corrosion Inhibitor, Clay Control/Stabilizer, Iron Control, Friction Reducer) |

| Geographical Segmentation | North America (U.S., Canada, Mexico) Europe (UK, Germany, Italy, France, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, Rest of APAC), South America (Brazil, Argentina, Rest of SA), MEA (UAE, Saudi Arabia, South Africa) |

| Key Companies Profiled | Halliburton (U.S.), Schlumberger (U.S.), Baker Hughes (U.S.), DuPont (U.S.), AkzoNobel (Netherlands), BASF (Germany), and Ashland (U.S). |

|

|

|