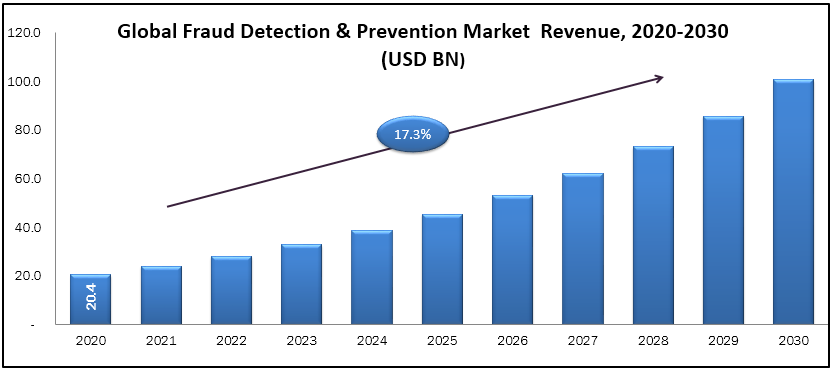

Fraud Detection and Prevention is a term that involves detecting fraud before & after it takes place, and taking appropriate measures to prevent it. Fraud detection is a set of activities which, to prevent money or property from acquiring through false pretences. Fraud detection & prevention is applied to many industries such as banking, insurance, telecom, software, etc. according to standards, the primary responsibility for the prevention and detection of fraud rests with governing body and management. The advanced technologies such as big data, data analytics, predictive modelling, deep learning, cloud computing, machine language, and artificial intelligence will help to grow the market. The market size of the Fraud Detection and Prevention Market is anticipated to grow from USD 20.4 billion in 2020 to USD 100.6 billion by 2030, at a CAGR of 17.3%, during the forecast period.

Market Segmentation:

The global fraud detection and prevention (FDP) market is segmented by the solution are fraud analytics, authentication, monitoring and reporting, governance. Companies are adopting authentication solutions to secure logins and passwords, to establishing higher consumer trust. By service they are divided into further, professional services, managed Services. By application, it can be segmented into identity theft, payment frauds, and money laundering, mobile fraud, electronic fraud. By end-use, the market is segmented into banking, insurance, government, healthcare, e-commerce, and education. On the basis of region, the market is classified into North America, Europe, Asia-Pacific, and RoW.

Market Dynamics and Factors:

The technologies such as cloud computing services, artificial intelligence, and rapid increase in mobile banking are key factors driving the growth of the fraud detection and prevention market. Additionally, rise in generation of enterprise data and its complexity, and growing incidence of fraud further supplement will lead to the fraud detection and prevention market growth. Due to the increase in fraudulent activities across the globe is expected to have a significant impact on the growth of the market. Cloud technology provides remote server access on the internet and enables organizations to manage all the applications. Currently, enterprises are more inclined to fraud incidents resulting in financial losses due to the generation of massive amounts of enterprise data coupled with increase in technological advancements. However, the high initial cost of these solutions restrains the growth of this market.

Geographic Analysis:

North America is the dominant region for the fraud detection & prevention market in 2016, because of industrial expansion and rise in fraudulent activities, and it will continue for upcoming years. The fraud analytics segment is expected to generate the highest CAGR during the forecast period, owing to the increase in implementation of various government regulations related to security for different industries. Asia-Pacific is considering a leading fraud detection and prevention market growth and is expected to maintain this trend in the future as well, growing further at a CAGR of 19.2% during the forecast period. This is due to growth in the increased use of the Internet, and an increase in usage of mobile data for various applications such as social media and mobile banking, which indirectly drives the fraud detection and prevention market growth.

Competitive Scenario:

The major key players in the market are ACI Worldwide Inc., Arbutus Software Inc., Experian plc, Avast Software s.r.o., AVG Technologies (Avast Software s.r.o.), DXC Technology Company, ESET spol. s.r.o., FRISS, GreatHorn, Inc., IBM Corporation, SAP SE, SAS Institute Inc., SpyCloud, Inc., Trulioo, Verifi, Inc., Webroot Inc. Fiserv, Inc., Guardian Analytics, Fidelity National Information Services Inc, First Data Corporation, and LexisNexis Risk Solutions.

Fraud Detection and Prevention (FDP) Market Report Scope

| Report Attribute | Details |

| Analysis Period | 2020–2030 |

| Base Year | 2021 |

| Forecast Period | 2022–2030 |

| Market Size Estimation | Billion (USD) |

| Growth Rate (CAGR%) | 17.3 % |

|

| By Solution (Fraud Analytics, Authentication, Monitoring and Reporting, Governance), By Service (Professional Services and Managed Services), By Application (Identity Theft, Payment Frauds, and Money Laundering, Mobile Fraud, Electronic Fraud), By End-Use (Banking, Insurance, Government, Healthcare, E-Commerce, and Education) |

| Geographical Segmentation | North America (U.S., Canada, Mexico) Europe (UK, Germany, Italy, France, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, Rest of APAC), South America (Brazil, Argentina, Rest of SA), MEA (UAE, Saudi Arabia, South Africa) |

| Key Companies Profiled | ACI Worldwide Inc., Arbutus Software Inc., Experian plc, Avast Software s.r.o., AVG Technologies (Avast Software s.r.o.), DXC Technology Company, ESET spol. s.r.o., FRISS, GreatHorn, Inc., IBM Corporation, SAP SE, SAS Institute Inc., SpyCloud, Inc., Trulioo, Verifi, Inc., Webroot Inc. Fiserv, Inc., Guardian Analytics, Fidelity National Information Services Inc, First Data Corporation, and LexisNexis Risk Solutions. |