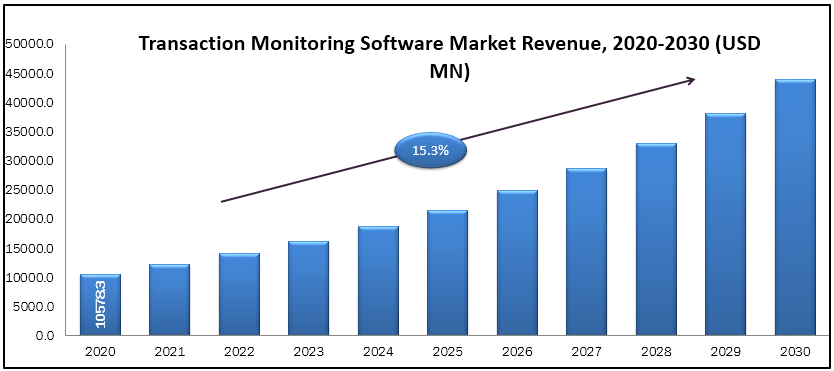

Transaction monitoring is the process of analyzing, identifying and monitoring the transactions that are processed through different business and individual financial systems. Transaction monitoring keeps the records of financial transactions of an individual and businesses, which helps in providing past financial transaction information at the time of requirement. The activities like deposit, withdrawal, transaction, transfer of amount are continuously tracked by the banking institutions and government bodies to access any criminal and fraudulent activities that may happen in future. In the past five years, it has been noticed that there has been a rise in the online criminal and fraudulent activities due to the rise in the online digital transactions and payment systems. This system helps the public and private sector organization to curb global issues like money laundering, counter-terrorist financing and online frauds. Transaction Monitoring Market size was valued to be USD 10578.3 billion in 2020 and is expected to be valued at USD 43924.7 billion by 2030. Global transaction monitoring software market is estimated to grow by approximate CAGR of 15.30% during the forecast period.

Market Segmentation:

Global transaction monitoring software market is segmented by component into software and service. By deployment the market is categorize into on-premise and cloud. By organization the market is classified into large enterprises and small & medium enterprises. By application, the market is analysed into anti-money laundering (aml), customer identity management, fraud detection and prevention (FDP), and compliance management. By end user the market is segmented by BFSI, government & defense, IT & Telecom, retail, healthcare, energy & utilities, manufacturing, and other. By region, the transaction monitoring software market is segregated into North America, Asia- Pacific, Europe and RoW.

Market Dynamics and Factors:

Owing to the increasing digital payment methods and online transactions all over the world have forced and public and government organizations to keep a track of it. Transaction monitoring is important to avoid any online fraud and loss of money and customers has boosted the transaction monitoring software market growth. However, due to the lack of transaction monitoring and anti-money laundering professionals, there is a restraint factor in the transaction monitoring software market growth. Moreover, due to the introduction of artificial technology and machine learning programs, it will boost the future growth of the market. Also, the requirement for transaction monitoring has been rising in the small and medium enterprises which will further boost the transaction monitoring software market in future. Owing to security reasons and data privacy issues it will be a constraint in the transaction monitoring software market growth.

Geographic Scenario

North America is the leading for transaction monitoring software market owing to an increasing number of cases like money laundering, online frauds, terrorist funding and others. The presence of major financial companies and banks has led to the rise in a large number of transactions causes requirement of these systems. North America market has more than 35% of transaction monitoring software market share in the year 2019 and it is expected that it will further grow to 45% by 2027. Asia Pacific market is expected to grow in faster rate with an estimated CAGR of 13% during the forecast period due to growth of technology and availability of software financial based software market. The estimated revenue in this region is expected to be USD 5 billion by 2025.

Competitive Scenario:

The key players in the transaction monitoring software industry are Oracle Corporation SAS Institute, Nice Ltd., ACI Worldwide Inc., BAE Systems, Fair Isaac Corporation, Thomson Reuters Corporation, Fiserv Inc., Software AG, and FIS.

Transaction Monitoring Software Market Report Scope

| Report Attribute | Details |

| Analysis Period | 2020–2030 |

| Base Year | 2021 |

| Forecast Period | 2022–2030 |

| Market Size Estimation | Billion (USD) |

| Growth Rate (CAGR%) | 15.3% |

|

| By Component (Software and Service), By Deployment (On-Premise and Cloud), By Organization (Large Enterprises and Small & Medium Enterprises), By Application (Anti-Money Laundering (AML), Customer Identity Management, Fraud Detection and Prevention (FDP), and Compliance Management), By End User (BFSI, Government & Defense , IT & Telecom, Retail, Healthcare, Energy & Utili-ties, Manufacturing, and Other) |

| Geographical Segmentation | North America (U.S., Canada, Mexico) Europe (UK, Germany, Italy, France, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, Rest of APAC), South America (Brazil, Argentina, Rest of SA), MEA (UAE, Saudi Arabia, South Africa) |

| Key Companies Profiled | Oracle Corporation SAS Institute, Nice Ltd., ACI Worldwide Inc., BAE Systems, Fair Isaac Corporation, Thomson Reuters Corporation, Fiserv Inc., Software AG, and FIS. |