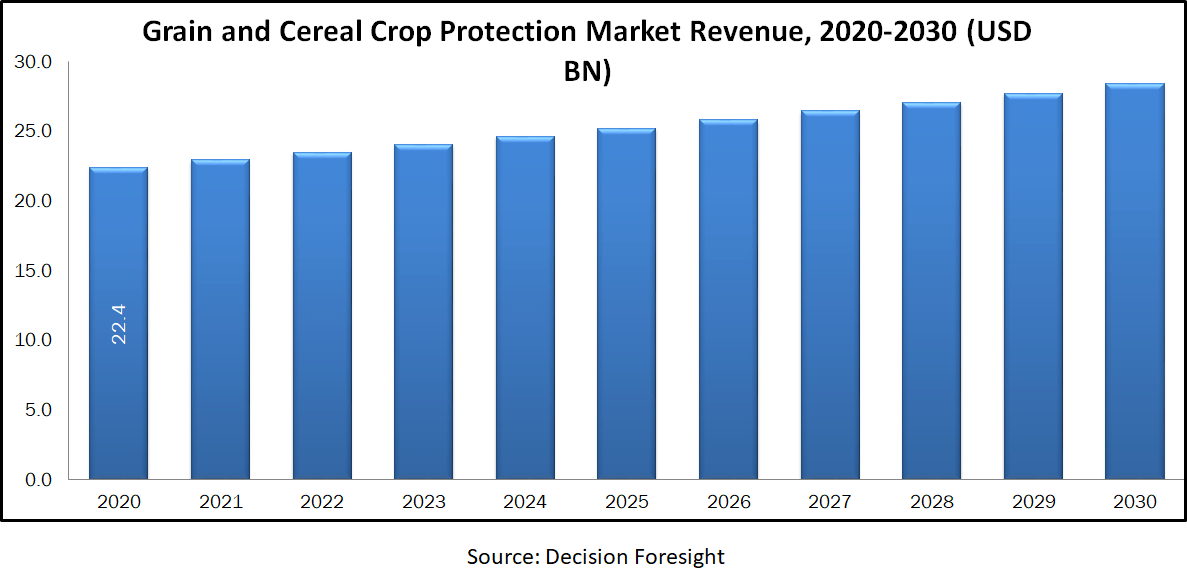

Grain And Cereal Crop Protection Market was valued at 22.4 USD billion in 2020 and is expected to rise by CAGR of 2.4% between From 2020-2030. Demand growth is driven by the increasing population's increasing need for food protection, developments in agricultural methods and technology, and severe loss of crops due to pest infestations. Factors such as increased demand for biopesticides, increased acceptance by farmers for Integrated Pest Management (IPM), and high prospects in developing countries further drive the market.

Market Dynamics and Factors:

In 2010, 70 percent of the cultivated land grows cereal crops, and the market for grain and cereal crop protection chemicals is significantly dependent on cereal production, according to the FAO. Increasing global population is causing further pressure to increase worldwide cereal production, leading to increased pesticide use in this section. In the last few years, demand for food protection and quality has been higher than ever and governments around the world are coming up with more strict rules and regulations to ensure that consumers get nutritious and safe food. Even the farmers are moving to organic farming. The increased use of bio-based crop protection technologies has been increasingly observed for crop protection. Farmers are now using cutting edge farming methods to boost crop yields, majorly cereal and grain crops. Key examples of this modern technology being utilized to develop agriculture include, crop sensors to track soil requirements, the use of smart phones to monitor irrigation etc.

Market Segmentation:

By type, the global grain and cereal crop protection market is bifurcated into herbicides, insecticides and fungicides. On the basis of crop type, the market is divided into vegetables & fruits, cereals & oilseeds, and others. By form, the market is segmented into solid and liquid. Based on application, the market is categorized into seed treatment, foliar spray, soil treatment and others. End user segmentation has been done into retailers, online, convenience stores and others. Geographically, the market is classified into regions including North America, Europe, Asia-Pacific and RoW.

Geographic Analysis:

South America accounted for the largest market share in global grain and cereal crop protection market, followed by Europe and Asia-Pacific. Brazil and Argentina contributed as the largest country markets in the South American region in 2015. Growing awareness regarding the profits of protection of crop among the farmers and rising population is leading to the growth of the market in this region. Asia-Pacific crop protection chemicals market is expected to increase different international manufacturers are investing i these regions. Also, widespread research has been done to explore the new type of global grain and cereal crop protection chemicals to be applied on different pests and also use them as an alternate options to pest resistant crop protection chemicals.

Competitive Scenario:

In the global grain and cereal crop protection market chemicals market key players identified include, E.I. du Pont de Nemours and Company (U.S.), The Dow Chemical Company (U.S.), Sumitomo Chemical Co., Ltd. (Japan), BASF SE (Germany), and Syngenta AG (Switzerland). Most of the key participants have been researching new areas y launching new product, collaborations, and acquisitions across the world to avail a competitive advantage.

Grain And Cereal Crop Protection Market Report Scope

| Report Attribute | Details |

| Analysis Period | 2020–2030 |

| Base Year | 2021 |

| Forecast Period | 2022–2030 |

| Market Size Estimation | Billion (USD) |

| Growth Rate (CAGR%) | 2.4 % |

|

| By Type (Herbicides, Insecticides, Fungicides), By Crop Type(Cereals & oilseeds, Fruits & vegetables and Others), By form (Solid, Liquid), By Application (Foliar spray, Seed treatment, Soil treatment, Others), By end users (Retailers, Online, Convenience Stores, Others) |

| Geographical Segmentation | North America (U.S., Canada, Mexico) Europe (UK, Germany, Italy, France, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, Rest of APAC), South America (Brazil, Argentina, Rest of SA), MEA (UAE, Saudi Arabia, South Africa) |

| Key Companies Profiled | E.I. du Pont de Nemours and Company (U.S.), The Dow Chemical Company (U.S.), Sumitomo Chemical Co., Ltd. (Japan), BASF SE (Germany), and Syngenta AG (Switzerland). |