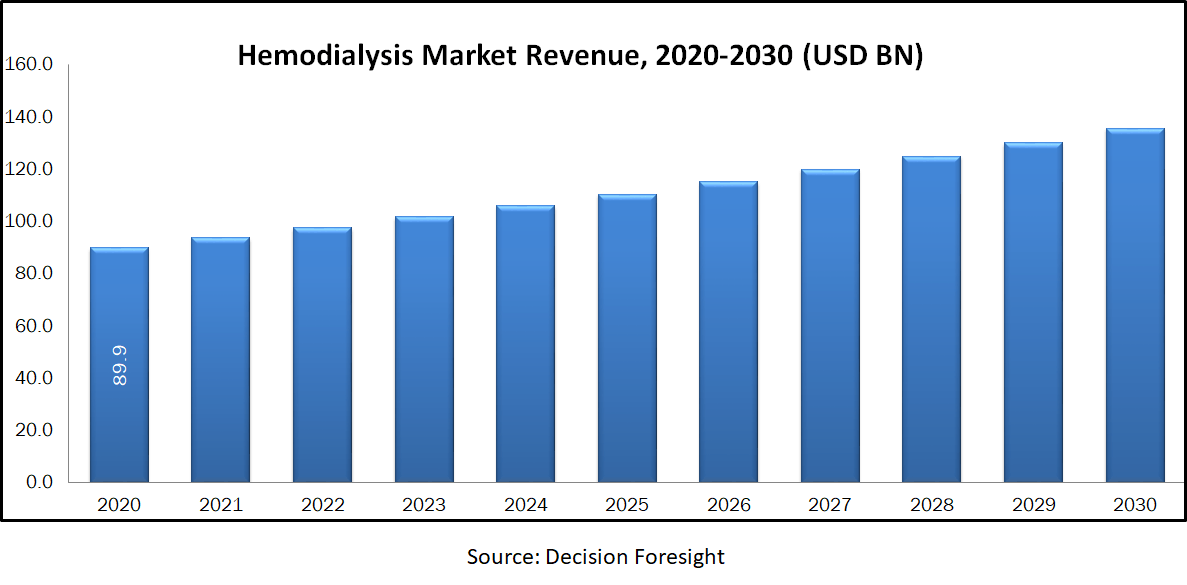

Hemodialysis Market reached a value of around 76.90 Billion USD in 2020 and is expected to reach 143.0 Billion USD by 2030 growing at a CAGR of 6.4%. Hemodialysis or simply dialysis is a process of purifying the blood of a person whose kidneys are not working normally. During this process, blood goes through a dialyzer so-called “artificial kidney”, outside the body and it removes wastes from the blood on the kidney’s behalf. In this procedure, a dialyzer, or artificial kidney, is used to filter excess fluids and toxins from the blood and restore the electrolyte balance. It removes waste products such as creatinine and urea from the blood and improves the functioning of the kidneys. It also aids in managing blood pressure levels and balances the concentration of minerals such as sodium, potassium and calcium in the circulatory system. Furthermore, the procedure prevents the accumulation of salts and other toxins that can damage and influence the functioning of other organs in the body. It is performed when the kidney function goes below 10%-15% or in case of kidney failure. According to the USRDS Annual Data Report 2018, End-stage renal disease (ESRD), also known as kidney failure, is the last stage of chronic kidney disease (CKD). Kidneys lose their filtering ability during ESRD/CKD, making dialysis a primary mode of treatment. About 2 million people are affected with ESRD each year globally. According to the National Kidney Foundation, 10% of the global population is affected by chronic kidney disease (CKD). Above 2 million people currently receive treatment with dialysis or a kidney transplant. Of these 2 million, people receive treatment for kidney failure, the majority are treated in only five countries: the U.S., Japan, Germany, Brazil, and Italy. These countries represent only 12% of the global population. Only 20% are treated in about 100 developing countries which make up over 50% of the world’s population.

Market Segmentation:

Based on type, it is bifurcated into hemodialysis and peritoneal dialysis. Hemodialysis is further categorized into conventional hemodialysis, short daily hemodialysis, and nocturnal hemodialysis. Peritoneal dialysis is sub-classified into continuous ambulatory peritoneal dialysis (CAPD) and automated peritoneal dialysis (APD). Based on products & services, it is divided into equipment, consumables, drugs, and services. Equipment is further categorized into dialysis machines, water treatment systems, and others. Consumables are classified into dialyzers, catheters, and transfer sets. Based on end-user, it is split into in-centre dialysis and home dialysis. On the basis of region, global hemodialysis market is segmented into North America, Asia Pacific, Europe, and ROW.

Market Dynamics and Factors:

According to the International Society of Nephrology, 1 out of 3 people in the general population is at an increased risk of CKD. The growing prevalence of diseases, such as End-Stage Renal Disease (ESRD) and Chronic Kidney Disease (CKD), across the globe, and shortage in availability of kidneys for transplants are the key factors driving the growth of the market. Additionally, various technological innovations, including the introduction of compact-sized machines that can be conveniently used for home-based treatments, are significantly boosting the product demand. Other factors such as enhanced research and development (R&D), favourable government policies to promote public healthcare infrastructure, and the rising trend of automation in treatment processes are projected to drive the market further. However, both infectious and noninfectious complications, and risks associated with dialysis like sepsis formation, negatively affect the adoption of this treatment among ESRD patients, thereby hampering the growth of the dialysis market. On the contrary home hemodialysis (HHD) is one of the most convenient modalities of hemodialysis available for the treatment of kidney diseases. Over the past few years, the acceptance of HHD has increased due to the advantages offered by this treatment, such as better patient outcomes and obedience, abridged travel expenses, an enriched quality of life, and enhanced health quality over conventional or in-centre hemodialysis. Likewise, increasing awareness among patients about home dialysis as a treatment option is further leading to rise in its adoption. NxStage Medical, Inc. (US) launched the NxStage System with enhanced priming features for HHD in 2016. This new feature decreases the time and energy consumed for patients to set up the system and advances the overall ease of use. Furthermore, Fresenius Medical Care (Germany) in 2019, developed home dialysis apparatus to influence on the growing market demand for HHD products. This HHD segment opens a new gateway of opportunity for the market.

Geographic Analysis:

The U.S. is considered the world’s largest shareholder of the market. Association between product manufacturers and service providers is supplementing the market. In 2017, Fresenius Medical Care AG & Co. KGaA announced the opening of eight new centres in collaboration with John Hopkins Hospital located in Baltimore, the U.S., to meet the growing demand in the region. Europe holds the second dominating position owing to an increase in chronic diseases and healthcare expenditure of the EU commission.

The Asia-Pacific region is projected to witness significant growth in future, owing to an increase in R&D investment and a surge in disease diagnosis awareness. Furthermore, this region presents remarkable opportunities for venture capitalists and investors, because the developed markets are comparatively saturated. Japan, India and China hold the largest share in this region owing to factors such as the increasing per capita income, improving healthcare infrastructure, and supportive government activities in these emerging countries. Moreover, the growing incidence of ESRD, increasing geriatric population, and the rising acceptance of home hemodialysis are also driving the growth of this regional market.

Competitive Scenario:

Major players in the market are Fresenius Medical Care AG & Co. KGaA, DaVita Healthcare Partners, Inc., Baxter International, Inc., Ion Nipro Corporation, Medtronic Plc, B. Braun Melsungen AG, NIKKISO CO., LTD, Diaverum Healthcare Partners, Asahi Kasei Corporation, Rockwell Medical, Inc., Becton, Dickinson and Company.

Hemodialysis Market Report Scope

| Report Attribute | Details |

| Analysis Period | 2020–2030 |

| Base Year | 2021 |

| Forecast Period | 2022–2030 |

| Market Size Estimation | Billion (USD) |

| Growth Rate (CAGR%) | 6.4 % |

|

| By Type (Hemodialysis {Conventional Hemodialysis, Short Daily Hemodialysis, and Nocturnal Hemodialysis}, and Peritoneal Dialysis {Continuous Ambulatory Peritoneal Dialysis (CAPD) and Automated Peritoneal Dialysis (APD)}), By Products & Services (Equipment {Dialysis Machines, Water Treatment Systems, and Others}, Consumables {Dialyzers, Catheters, and Transfer Sets}, Drugs, and Services), and By End User (In-Center Dialysis and Home Dialysis) |

| Geographical Segmentation | North America (U.S., Canada, Mexico) Europe (UK, Germany, Italy, France, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, Rest of APAC), South America (Brazil, Argentina, Rest of SA), MEA (UAE, Saudi Arabia, South Africa) |

| Key Companies Profiled | Fresenius Medical Care AG & Co. KGaA, DaVita Healthcare Partners, Inc., Baxter International, Inc., Ion Nipro Corporation, Medtronic Plc, B. Braun Melsungen AG, NIKKISO CO., LTD, Diaverum Healthcare Partners, Asahi Kasei Corporation, Rockwell Medical, Inc., Becton, Dickinson and Company. |