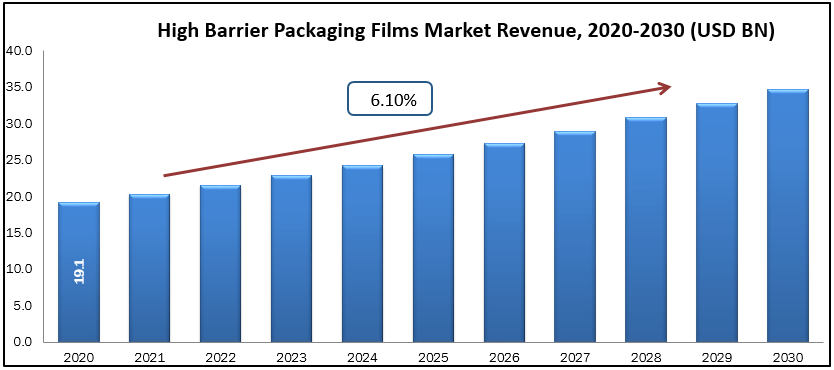

High Barrier Packaging Films Market size was valued at USD 19.1 billion in 2020 and is projected to reach USD 34.7 billion by 2030 growing with the CAGR of 6.1% during the forecast period 2020 to 2030. There is a risk of food spoiling during the picking, packaging, transportation, and storage processes. The most essential aspect in managing food goods for such a long length of time without affecting their quality is their packaging. It is critical to supply the important barrier characteristics (Moisture, Gas, and Aroma) in order to maintain the product's integrity. Barrier Films serve an important function in extending the shelf-life of the product while also assisting in making the structure entirely recyclable with all layers belonging to the same polymer family.

Barrier films feature a solvent-free, impermeable co-extruded and flexible structure (single or several layers) that does not react with the packed food. It helps to avoid interaction with oxygen, carbon dioxide, or moisture, while also limiting mineral oil and UV radiation migration. This strict barrier, made of specific materials, also preserves food characteristics such as colour, taste, texture, fragrance, and flavour.In the medical industry, high barrier packaging films are primarily used to protect medications from oxygen, water, light, moisture, chemicals, bacteria, and germs, as well as to safeguard medical items. The films are tough, tear-resistant, and puncture-resistant, which is important for packing and shipping. Furthermore, when barrier packaging sheets are used for packaging, the visibility of the drug is increased. Furthermore, high barrier coatings protect pharmaceutical items from environmental effects, maintain quality, and extend product shelf life.

Market Segmentation:

- Product Insights

Based on the type of barrier films, market can be segmented based on the Metalized Films, Clear Films, Organic Coating Films, Inorganic Oxide Coating Films. Metalized films are more popular in this segment. Metalized BOPP barrier films that are corona treated on both sides and may be utilised for duplex as well as sandwich lamination in snack foods, shampoo sachets, dry milk powder sachets/packs, and powdered beverages sachets/packs when moisture loss is a problem. BOPP metalized moisture and oxygen barrier films were developed specifically for packaging applications needing strong seal strengths. BOPP metalized moisture and oxygen barrier films have a high hot tack and low SIT, allowing packaging machines to operate faster and therefore enhance production.These are opaque and do not allow light to pass through, making them ideal for light-sensitive items. The printing on the pouches is more apparent due to their opacity and does not require any underpricing. They are inexpensive and have good barrier characteristics.

- Material Insights

On the basis of material the High Barrier Packaging Films can be segmented into Plastic, Aluminium, Oxides & Other. The plastic segment is most dominant in the High Barrier Packaging Filmmaterial segment. As the essential bundling materials are plastic since it secures the drug item against oxygen and scent, water fume transmission, dampness, defilement, and microbes. These properties make polypropylene material a good choice for high barrier blister packaging. Polypropylene high-boundary films have a high meltinXg point makes it reasonable for boilable bundles and for sterilizable items. Additionally, items stuffed in thermoforming films have higher item perceivability in light of the fact that without compromising with the hindrance properties of the bundling. These films are puncture resistance which enables manufacturers to use their products for packaging and can also help in easy transportation.

- End User Insights

On the basis of End User the High Barrier Packaging Films can be segmented into Food & Beverages, Pharmaceuticals, Electronic Devices, Medical Devices, Agriculture, Chemicals, Others. Food & beverage market is dominant in this segment. Consumers' shifting food consumption habits are driving their desire for ready-to-eat foods. Furthermore, the industry is anticipated to develop due to a busy lifestyle, a lack of time for cooking at home for working professionals, students ready to spend more money on packaged food, and an increase in the desire for handy goods. Ready-to-cook, freezer-to-microwave, ready-made packaged meals, and processed foods are in great demand since they are simple to transport, open, and need less time to prepare. Food delivery to homes or workplaces, as well as food-on-the-go and food-on-the-shelf goods, are becoming increasingly popular. However, following interaction with the environment, chemicals, and atmospheric conditions, such processed food items lose food quality. As a result, superior packaging with high barrier packaging films can extend the shelf life of these items; high barrier packaging films keep the food exceptionally fresh.

Geographical Analysis

North America is expected to see substantial expansion in the high barrier packaging films market. Because of the increased demand for consumer products and packaged food. Furthermore, an increase in the applications for high barrier film packaging is expected to drive the expansion of high barrier packaging films in the area in the future years. The rising production and demand for milk and other packaged beverages is driving up the demand for barrier films. According to the United States Department of Agriculture (USDA), the US produced 217,500 million pounds of milk in 2018. The food sector accounts for more than 5% of US GDP and is continually expanding due to increased demand for packaged goods. The benefits of convenience at home and on-the-go flexibility have become important elements driving the purchasing of packaged meals.

In Europe, Consumers' increasing online buying tendency and excessive usage of smartphones are driving a game-changing shift for an e-commerce firm. Tear-resistant, flexible, transparent, and tamper-proof alternatives are available for high barrier packaging film. It protects the goods from damage and environmental impacts, allowing for easy and safe product shipment and transit.

Supermarkets are becoming increasingly popular among consumers due to their extensive selection of premium brand products. Furthermore, due to their prolonged shelf life and improved food quality, items with high barrier packaging film packaging are making inroads into hypermarkets and large retail chains in developed nations of Europe.

Asia Pacific dominates the market for high barrier packaging filmsbecause of the growth in industry and urbanization in developing nations, Furthermore, the region's high barrier packaging film growth will be aided by the availability of raw materials and cheap labor costs throughout the projected period. Because of the increased demand for consumer products and packaged food, North America is expected to see substantial expansion in the high barrier packaging films market. Furthermore, an increase in the applications for high barrier film packaging is expected to drive the expansion of high barrier packaging films in the area in the future years.

In Middle East & Africa, there are several key players who are currently operating in this sector more actively in order to achieve a high value of market share and lead the fastest market growth in the coming years in the Middle East and Africa while investing heavily in technological advancements that further increase the efficiency of the barrier films and benefit from increased revenue.There are several key players who are currently operating in this sector more actively in order to achieve a high value of market share and lead the fastest market growth in the coming years in the Middle East and Africa while investing heavily in technological advancements that further increase the efficiency of the barrier films and benefit from increased revenue.

Key Companies Insights

In June 2021, Sappi Limited, a major global producer of strong everyday materials derived from woodfibre-based renewable resources, today announced a collaboration with EcoVadis, a global pioneer in third-party assessments of company sustainability performance. The two businesses will work together to analyse Sappi's suppliers' sustainability performance through proactive ratings and assessments using EcoVadis' approach. The new collaboration will encourage ethical corporate practises that are in line with the United Nations Sustainable Development Goals.

- Winpak Ltd.

- Uflex Ltd.

- Cosmo Films Ltd.

- Bischof & Klein SE & Co. KG

- ProAmpac Intermediate, Inc.

- Plastissimo Film Co., Ltd.

- Amcor Plc

- Sealed Air Corp

- Glenroy, Inc.

- Celplast Metallized Products Ltd.

- Mondi Plc

- Toray Plastics (America) Inc.

- Schur Flexible GmnH

- Huhtamaki Oyj

- Jindal Poly Films Ltd.

High Barrier Packaging Films Market Report Scope

| Report Attribute | Details |

| Market size value in 2020 | USD 19.1 billion |

| Revenue forecast in 2030 | USD 34.7 billion |

| Growth Rate | CAGR of 6.1% from 2021 to 2028 |

| Base year for estimation | 2019 |

| Historical data | 2016 - 2019 |

| Forecast period | 2020 - 2030 |

| Quantitative units | Revenue in USD million and CAGR from 2020 to 2030 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Product Insights (Metalized Films, Clear Films, Organic Coating Films, Inorganic Oxide Coating Films),By Material Insights (Plastic, Aluminum, Oxides & Other),By End User Insights (Food & Beverages, Pharmaceuticals, Electronic Devices, Medical Devices, Agriculture, Chemicals, Others) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; South Korea; Brazil; Mexico; South Africa; Saudi Arabia; UAE |

| Key companies profiled | Winpak Ltd., Uflex Ltd., Cosmo Films Ltd., Bischof & Klein SE & Co. KG, ProAmpac Intermediate, Inc., Plastissimo Film Co., Ltd., Amcor Plc, Sealed Air Corp, Glenroy, Inc., Celplast Metallized Products Ltd. |