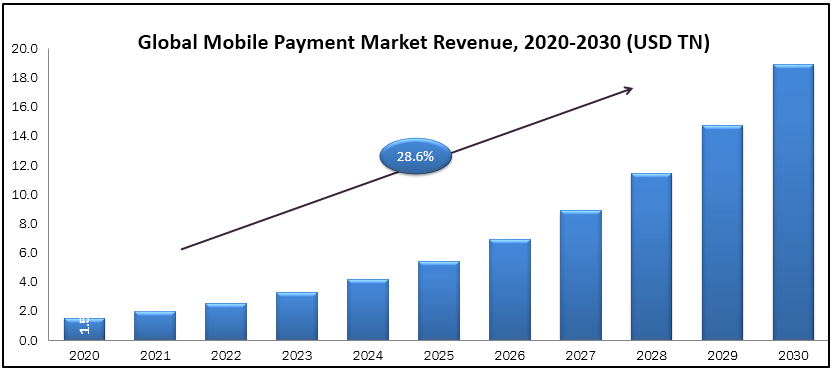

A Mobile Payment is money transfer or payment that made for a service or a product by using electronic gadgets such as mobile, tab, and smartphone. In the mobile transaction, a code is generated that can be send by (over the air) OTA or manually this is done by internet connection. About 80% global population use mobile or smartphones in day to day life. In 2019 60% people using mobile payment for services and product. Payment can be done at any time by using it, account balance can be check from anywhere, it is cost effective, and risk free are the some advantages of mobile payment. Privacy issue, not supported in some smart phones, and payment error are some disadvantages of it. Mobile Payment Market was valued USD 1.5 trillion in 2020 and it anticipated to reach USD 18.9 trillion in 2030, with 28.60% CAGR in forecast period.

Market Segmentation:

On the basis of mode of transaction, the global mobile payment market is segmented into NFC (near field communication), SMS (short message service), and WAP (wireless application protocol). On the basis of type of mobile payment, the market is categorized into mobile wallet, bank cards, and mobile money. On the basis of application, the market is divided into entertainment, healthcare, energy and utilities, transportation & hospitality, and others. Geographic breakdown and analysis of each of the aforesaid segments includes regions comprising North America, Europe, Asia-Pacific, and RoW.

Market Dynamics and Factors:

The mobile payment can make easily and more convenient for costumer to pay for product as comparing with credit card and cash. Costumer have not to put card or cash in pocket every time as all necessary information is saved in the mobile. That are the factor which drive the growth of the market. Due to E-commerce online payment is increase and online shopping, ordering food that factor fueling the growth of the market. Sometime payment error, risk of phone theft, and difficult to read terms and condition are the factor that may hamper the growth of the market.

Geographic Analysis:

Asia pacific lead the global mobile payment market, with CAGR of 36.8%. As country like china, japan and India use most mobile payment. According Viva Inc. their company has crossed more than 20 billion contactless card in India, about 40% of transection in India is done by using it, and in Australia 70% of transection are done by using QR transection by visa. In India in 2018, demonetization act brought wise spread about other mode of payment. North America, Latin America and Europe market is also growing with 29.7% CAGR. As they are developed region mobile payment use more there.

Competitive Scenario:

Some of the major key player in the global mobile payment market are Orange S.A., MasterCard Incorporated, Vodacom Group Limited, MTN Group Limited, Bharti Airtel Limited, PayPal Holdings, Inc., Econet Wireless Zimbabwe Limited, Mahindra Comviva, Millicom International Cellular and etc.

Mobile Payment Market Report Scope

| Report Attribute | Details |

| Analysis Period | 2020–2030 |

| Base Year | 2021 |

| Forecast Period | 2022–2030 |

| Market Size Estimation | Tillion (USD) |

| Growth Rate (CAGR%) | 28.6 % |

|

| By Mode Of Transaction (SMS, NFC, And WAP), By Type Of Mobile Payment (Mobile Wallet/Bank Cards And Mobile Money), By Application (Entertainment, Energy & Utilities, Healthcare, Retail, Hospitality & Transportation, And Others) |

| Geographical Segmentation | North America (U.S., Canada, Mexico) Europe (UK, Germany, Italy, France, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, Rest of APAC), South America (Brazil, Argentina, Rest of SA), MEA (UAE, Saudi Arabia, South Africa) |

| Key Companies Profiled | Orange S.A., MasterCard Incorporated, Vodacom Group Limited, MTN Group Limited, Bharti Airtel Limited, PayPal Holdings, Inc., Econet Wireless Zimbabwe Limited, Mahindra Comviva, Millicom International Cellular and etc. |