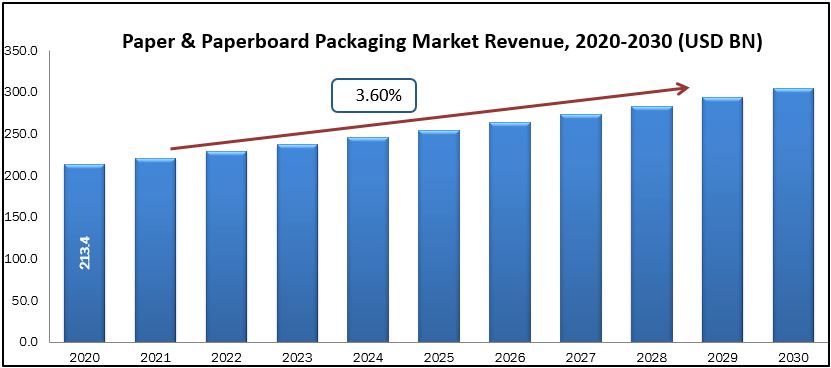

Paper & Paperboard Packaging market size was valued at USD 213.4 billion in 2020 and is projected to reach USD 303.9 billion by 2030 growing with the CAGR of 3.6% during the forecast period 2020 to 2030. Papers and paperboards are sheet materials made up of a cellulose fibre network that is interwoven. They're printable and have the qualities to be formed into a variety of flexible, semi-rigid, and stiff packaging. There are many different types of paper and paperboard. The kind and amount of fibre used, as well as how the fibres are treated in fibre separation (pulping) and fibre treatment in paper and paperboard manufacturing, can affect the appearance, strength, and many other qualities.Paper is a thin substance made by pressing damp cellulose pulp fibres obtained from wood pulp, rags, or grasses into a flexible sheet, then treating and drying them. It's a versatile substance that may be used for a variety of purposes, including writing, printing, packing, and a variety of industrial and construction operations. Paperboard is a thick paper-based substance; nevertheless, the distinction between paper and paperboard is not always clear. Paperboard, according to ISO standards, is a paper having a weight more than 224 g/m2. Single-ply or multi-ply paperboard is available. Paperboard is lightweight, robust, and can be readily cut and moulded. It is used in packing. Graphic printing, such as book and magazine covers or postcards, is another application for paperboard.

Market Segmentation:

- Product Insights

Based on Product the Paper & Paperboard market can be segmented kraft paperboard, Label paper, White line chipboard (WLC), Folding boxboard (FBB), and Others. White Lined chipboard is dominant among the segment. Foods, personal care, health care sectors, textiles, and toiletries are just several of the uses for white lined chip board. White-lined chipboard (also known as WLC, GD, GT, or UD) is a kind of paperboard produced from waste paper or recovered fibre layers. On the top, it usually has two to three layers of coating, with one layer on the opposite side. It will be grey on the inside due to the recycled material. This type of board is mostly used to package frozen or chilled foods, cereals, shoes, toys, and other items. Because of its lower mechanical stress resistance, white lined chipboard is not appropriate for big and bulky objects. The usage of recycled material for packaging also has a number of health hazards, which is limiting the worldwide white lined chipboard market.

- Application Insights

On the basis of application, the Paper & Paperboard packaging market is divided into Corrugated box, Boxboard, and Flexible paper packaging. Corrugated boxes, folding cartons, and other flexible paper packaging solutions that offer maximum protection during shipping and handling will establish a strong presence in the global paper packaging market as online shopping platforms become more popular. Paper packaging is easily recyclable and does not harm the environment in any way. The global drive for recyclability in the paper packaging sector will open up huge potential for recycling businesses all around the world. Recycled paper packaging also has a significant economic benefit in the manufacture of corrugated boxes and cartons, as well as other paper packaging options.

- End Use Insights

The market is segmented on the basis of end use as pharmaceutical, electronics, healthcare, chemicals, food & beverage and others. Because food producers are increasingly using paper-based packaging goods, the food & beverage category has the biggest share of the worldwide market. Furthermore, due to their hectic lifestyles, customers are drawn to a variety of packaged food products. Because of the global development of the electronics sector and the adoption of small, lightweight electronic goods, the electronics application category is expected to grow rapidly in the future, creating attractive possibilities for Paper Packaging And Paperboard Packaging. Depending on the final application, it is commonly employed as a main or secondary packaging material. In the e-commerce sector, it is critical to consider the impact of receiving a damaged delivery on the consumer experience.

Geographical Analysis

In the North American area, the United States dominates the Paper & paperboard industry, with food projected to be the leading end-user of folding cartons. The US food sector, for example, is anticipated to grow at a constant pace of 2.9 percent CAGR through 2022, according to the Association for Packaging and Processing Technologies. In 2018, the US government imposed a ten percent tax on Chinese folding cartons, which was set to rise to twenty-five percent in January 2019. However, in December 2018, the US and China decided to put any tariff increases on hold for the time being. The increase in tariffs is projected to lead to an increase in domestic output.

By 2021, the European Union wants to abolish single-use plastic. Furthermore, as compared to other nations, European consumers have a far higher level of environmental awareness. These reasons are mostly boosting European market growth. As online shopping becomes more popular, more merchants in Europe are focusing on building online storefronts, which is fuelling demand for plastic Paper & Paperboard packaging. However, the availability of efficient sustainable alternatives in the region is expected to keep demand for Paper & Paperboard packaging under check. Furthermore, the region's strict laws on the use of plastic are expected to stymie the use of plastic Paper & Paperboard packaging to some extent

Asia Pacific gained a large market revenue share, with a high CAGR. Market expansion would be aided by rising demand for insulated packaging from industries such as food and beverage. During the projected years, an increase in demand for insulated packaging for the packaging of food goods from E-commerce channels will be another market driving factor. Paper & Paperboard packaging market growth has been fueled by rising online food ordering in key nations such as China, Japan, India, and other Asia Pacific countries. Paper & Paperboard packaging is essential for e-commerce meal delivery and grocery delivery, since it ensures that products arrive securely. The increasing use of E-commerce for purchases in India, Japan, and China is a major driver driving market expansion in the Asia Pacific region. Because of the increased interest in access, the E-commerce industry in India and China, for example, is steadily developing.

In Middle East & Africa Low supply and shrinking profit margins prompted a significant shift in the Middle East packaging sector, allowing manufacturers/vendors to use creative and novel packaging to enhance sales. The Middle East's buying power has risen as a result of high job levels and a strong economy, boosting demand for packaging throughout the area. In the MEA Region, the e-commerce business has already established itself as a key sales channel for a diverse range of items, from food and drinks to consumer electronics and home and beauty care. Additionally, the expansion of the market for Paper & Paperboard packaging solutions has been aided by the rise in online sales, as these solutions allow vendors to assure the safe delivery of their items offered online.

Key Companies Insights

Companies are engaged in various strategies, such as mergers &acquisitions, product launches, partnerships, and joint ventures to gain a greater market share.In May 2020, The purchase of Orora Limited's paperboard and fibre-based packaging business in Australia and New Zealand has been completed by Nippon Paper Industries Co., Ltd. and Paper Australia Pty Ltd (“Australian Paper”), a fully owned subsidiary of Nippon Paper Industries. The company has been formed into a new trade entity, and it will create the “Opal” group of firms alongside Australian Paper. Opal will grow its packaging solution business from upstream (manufacturing/converting renewable packaging goods) to downstream (packaging-related materials and associated services) to a wide range of clients in Oceania and the worldwide market, leveraging its unique business model.

- Smurfit Kappa Group PLC

- Sonoco Products Company

- Stora Enso Oyj

- Cascades Inc.,

- ITC Ltd.

- DS Smith Plc

- Clearwater Paper Corporation

- Nippon Paper Industries Co. Ltd

- International Paper Company

- KapStone Paper and Packaging Corporation

- Mayr-MelnhofKarton AG

- Mondi Ltd.

- Pratt Industries, Inc.

- Rengo Co., Ltd.

Paper & Paperboard Packaging Market Report Scope

| Report Attribute | Details |

| Market size value in 2020 | USD 213.4 billion |

| Revenue forecast in 2030 | USD 303.9 billion |

| Growth Rate | CAGR of 3.6% from 2021 to 2030 |

| Base year for estimation | 2019 |

| Historical data | 2016 - 2019 |

| Forecast period | 2020 - 2030 |

| Quantitative units | Revenue in USD million and CAGR from 2020 to 2030 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Product Insights (Kraft Paperboard, Label Paper, White Line Chipboard (WLC), Folding boxboard (FBB), and Others),By Application Insights (Corrugated box, Boxboard, and Flexible Paper Packaging), By End Use Insights (Pharmaceutical, Electronics, Healthcare, Chemicals, Food & Beverages and Others) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; South Korea; Brazil; Mexico; South Africa; Saudi Arabia; UAE |

| Key companies profiled | Smurfit Kappa Group PLC, Sonoco Products Company, Stora Enso Oyj, Cascades Inc.,, ITC Ltd., DS Smith Plc, Clearwater Paper Corporation, Nippon Paper Industries Co. Ltd, International Paper Company, KapStone Paper and Packaging Corporation, Mayr-MelnhofKarton AG, Mondi Ltd., Pratt Industries, Inc., Rengo Co., Ltd. |