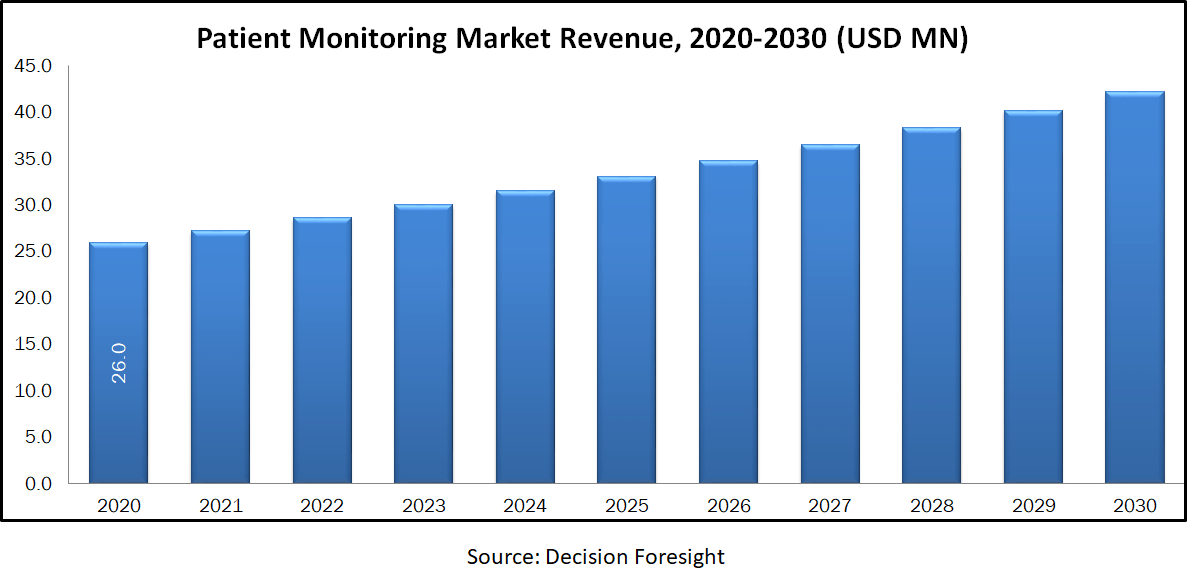

Patient Monitoring Devices Market was valued at USD 25.98 billion by 2020, growing with 4.98% CAGR during the forecast period, 2021-2030.

Patient monitors measure, record, disseminate, and display biometric data such as heart rate, SPO2, blood pressure, temperature, and others. High-capacity, multi-function monitors are commonly used in hospitals and clinics to provide high-quality patient care. Portable patient monitors are made to be small and energy efficient. Patient monitoring devices enables to utilized in remote regions or by paramedics to help in field diagnosis, as well as to monitor and communicate data to healthcare providers in other locations.

In recent years, both patients and healthcare professionals have increased their use of sensor-based wearable devices such as continuous glucose monitors, ECGs, and others. These devices can track the patient's vital signs in real time, which can subsequently be electronically communicated to their doctors and connected with the EHR. This enables doctors to continually monitor the patient, reducing the need for frequent hospital visits. The growing demand for wearable devices has prompted major companies to do extensive research and introduce novel products in the market for digital patient monitoring devices.

Market Dynamics and Factors:

Reduced public healthcare expenditures across Europe continue to hinder development in many patient monitoring segments, particularly mature ones. Government purchasing choices, such as the National Health Service (NHS) and the diagnosis-related group (DRG), have increased the importance of pricing in the capital equipment procurement process. Budget constraints have also led to hospital closures or mergers in favour of consolidated treatment centres. These characteristics have allowed low-cost competition to continually grasp patient monitoring devices market opportunities; as a result, the price of medical equipment continues to fall, particularly in smaller nations with fewer large manufacturers.

According to the World Health Organization 2020, major chronic illnesses such as cancer, chronic obstructive pulmonary disease, cardiovascular diseases (CVD), and diabetes are expected to account for 73 percent of all deaths and 60 percent of the global disease burden in 2020. Globally, as of 21 June 2021, there have been 178,202,610 confirmed cases of COVID-19, including 3,865,738 deaths. This data suggests the need for reinforcement of healthcare system

Market Segmentation:

Global patient monitoring devices market share can be segmented on the basis of By Product Type (Vital Sign Monitors, Multi parameter Monitors, Sleep Monitors, Hemodynamics Monitor, Fetal Monitors, Weight Monitoring Devices, Temperature Monitoring Devices, Neuro-monitors, Cardiac Monitor, Respiratory Monitors, Other Monitors) By User (Home Setting, Hospitals, Clinics), By Market Location (North America, Europe, Asia Pacific, Latin America, Middle East and Africa).

Geographic Analysis:

North America share is predicted to account for the majority of patient monitoring devices market share and to maintain its dominance throughout the projection period. Due to an increase in the incidence of chronic illnesses, the area is expected to be a profitable market for monitoring device makers. Increased consumption of an unhealthy diet, massive healthcare spending, and favourable health-care programmes have fuelled the patient monitoring market growth.

Europe is expected to own the markets second-largest share for the patient monitoring devices market. Factors such as mandatory contributing health insurance programmes and mandatory medical savings accounts, as well as rising healthcare expenditure, are anticipated to impact market expansion in the European area.

Asia Pacific has a significant patient monitoring devices market potential for development due to an increase in the elderly population, rising rates of heart disease, rising prevalence of diabetes, and an increase in the buying power of the region's countries. Furthermore, the fast-growing start-up ecosystem in this area, fuelled by the infusion of money, is expected to promote additional research and development activities towards developing innovative healthcare technologies, which are expected to drive market expansion.

Competitive Scenario:

The Patient Monitoring Devices market, which is highly competitive, consists of a few major players. The key players of patient monitoring devices market are Biotronik, Schiller BioTelemetry, Inc., Edwards Life sciences Corporation, Omron Corporation, Masimo Corporation, Compumedics Limited, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Abbott Laboratories, Hill-Rom Holdings, Inc., Nihon Kohden Corporation, Medtronic plc, Koninklijke Philips N.V., GE Healthcare, Getinge AB, Boston Scientific Corporation, Dexcom, Inc., GE Healthcare and many others.

Patient Monitoring Devices Market Report Scope

| Report Attribute | Details |

| Market size value in 2020 | USD 25.98 billion |

| Growth Rate | CAGR of 4.98% from 2021 to 2030 |

| Forecast period | 2021 - 2030 |

| Quantitative units | Revenue in USD billion 2020 to 2030 and CAGR from 2021 to 2030 |

| Report coverage | Revenue forecast, Market Share Analysis, Sales Analysis, Competitor Analysis, Growth factors, and trends, Macro-economic indicator analysis, PORTER's Five Forces analysis, Pricing Analysis, PESTEL Analysis, Value Chain Analysis, COVID-19 Impact Analysis |

| Segments covered | By Product Type (Vital Sign Monitors, Multi parameter Monitors, Sleep Monitors, Hemodynamics Monitor, Fetal Monitors, Weight Monitoring Devices, Temperature Monitoring Devices, Neuro-monitors, Cardiac Monitor, Respiratory Monitors, Other Monitors), By User(Home Setting, Hospitals, Clinics) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Country scope | U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Japan; China; India; Malaysia; Singapore; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Turkey |

| Key companies profiled | Biotronik, Schiller BioTelemetry, Inc., Edwards Life sciences Corporation, Omron Corporation, Masimo Corporation, Compumedics Limited, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Abbott Laboratories, Hill-Rom Holdings, Inc., Nihon Kohden Corporation, Medtronic plc, Koninklijke Philips N.V., GE Healthcare, Getinge AB, Boston Scientific Corporation, Dexcom, Inc., GE Healthcare |