Market Overview:

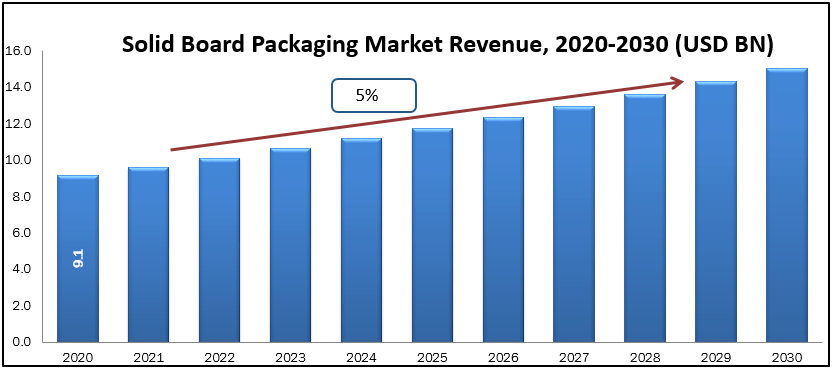

The Solid Board Packaging market size was valued at USD 9.1 billion in 2020 and is projected to reach USD 15 billion by 2030 growing with the CAGR of 5% during the forecast period 2020 to 2030. The material has a direct impact on the quality of our packaging solutions. For many years, market has been the searching & designing the most appropriate packaging (The Perfect Body) for fresh and frozen products. Solid cardboard is a type of cardboard that is sturdy, compact, and flexible, and it keeps its strength even when wet. Unlike corrugated cardboard, it does not have an insulating property, therefore it freezes 35 percent faster. Thanks to very efficient folding methods, many sophisticated packing structures are feasible. Solid cardboard is the more environmentally friendly option, as it is 100% recyclable and food safe.

The rising urbanization in developing economies coupled with fast pace globalization of the supply chain has resulted in Solid board packaging market growth. Amidst the high growth rate in packaging, consumer groups in these countries are increasingly becoming aware of environmental issues and prefer eco-friendly products over traditional non-Solid board-based products. Intense pressure from activist groups, governments, and media has encouraged manufacturing companies to make their products, packaging, and operations sustainable.

Market Segmentation:

- Material Insights

Based on Material the Solid Board packaging market can be segmented as Virgin material & Recycled material. The Corrugated packaging is dominant in the product type segment. Recycled material is dominant in this segment. Solid board made from recycled paper waste, conversion factories, and consumer sources is known as recycled solid board. Multiple substrates, ranging from six to nine plies, make up recycled solid board. During the recycling process, a tiny proportion of virgin fibres is introduced to improve the strength. In comparison to virgin substrates, recycled Solid boards offer reduced stiffness per unit weight and internal printing surfaces, as well as cost benefits, making them a more cost-effective solid board option in the folding carton and packaging sector.North America and Europe, for example, are significant drivers in the paper recycling market. Several government efforts and expenditures in recovery infrastructure have resulted in higher recycling rates and customer involvement as a result of consumer education campaigns.

- Application Insights

Based on Material the Solid Board packaging market can be segmented as Boxes, POP Displays Edge Protectors, Trays, and Layer Pads. Edge Protectors is currently trending component in application segment. Packaging materials are required when shipping goods or exporting commodities to prevent damage to the contents. Consumer items are commonly packaged in main and secondary packaging types such as rigid boxes, corrugated boxes, and folding cartons. Damage to such stiff primary and secondary packing forms is caused by complex and lengthy supply chains. Edge guards are essential for preventing damage to main packaging during supply chain and logistical activities. Edge protectors help to decrease the risk of product loss when it's time to replace it.For handling and transporting large weight batches of consumer items, an edge protector provides efficient cushioning. Edge protectors also give packing material interior support, making product transportation easier. One of the advantages of using an edge protector is that it keeps the material's static strength, preventing it from being crushed when packed in a box.

- End Use Insights

On the basis of End use, the Solid Board packaging market is divided into Chemicals, Food & Beverages, Consumer electronics, Construction, Others. The largest end-use category was food and beverage, and this trend is expected to continue during the projection period. The growing emphasis on eco-friendly and biodegradable packaging is expected to enhance demand for beverage packaging, increasing market trends in the process. Furthermore, as more producers embrace biodegradable, recyclable, and compostable packaging, the market will see increased growth in the coming years. The government's introduction of tight plastic usage rules has further hampered industry expansion. The prohibition on single-use plastic in numerous countries across the world, will have a simultaneous impact on the beverage packaging market share. Solid board is commonly used in retail stores not only to preserve food but also to maintain the nutritional value of the food so that it can be kept fresh for a long time. With a rising number of people purchasing grocery products, such as chilled and frozen meals, the industry is growing.

Geographical Analysis

In North America, The introduction of a restriction on certain plastic items has boosted the manufacture of solid board for boxing. During transportation, the packaging solution must assure structural integrity, safety, and quality. Solid board clamshell boxes are widely used in a variety of industries, including pharmaceuticals, foods, electronics, automobile cosmetics, and personal care, since they are simple to open, seal, and store. Fast food, frozen food, and cigarette packaging are only a few of the market's key drivers. Due to the good graphic retaining capacity of Solid board, the goods are available in a variety of sizes and shapes, and they can be readily modified. For example, the boxes can come with a variety of styles of beautiful printing on the top-lid.

The market for plastic solid board packaging will continue to be led by Europe. As online shopping becomes more popular, more businesses in Europe are focused on developing online storefronts, driving up demand for plastic Solid board packaging. The availability of cost-effective, environmentally friendly alternatives in the region, on the other hand, is anticipated to keep demand for plastic Solid board packaging in check. Furthermore, tight plastic-use restrictions in the region are likely to stifle the usage of plastic Solid board packaging to some extent. Because of the increasing need for fresh food and drinks, logistics, personal and home appliances, and electronic products, Europe is following in Asia Pacific's footsteps. Germany is a significant market for solid board packaging in Europe.

In the solid board packaging market, Asia Pacific accounts for the largest demand share. Due to the significant concentration of the manufacturing sector in the market, China is the leading country. Due to new developments in the electronic appliances industry, South Korea is expected to see an increase in regional solid board packaging demand. Rising demand for solid board packaging from industries such as food and beverage will assist market development. An growth in demand for solid board packaging for the packaging of food items from E-commerce channels would be another market driving element over the forecasted years. The expansion of the solid board packaging market has been fuelled by the rise of online food ordering in important Asian countries such as China, Japan, India, and others. For e-commerce meal delivery and grocery delivery, solid board packaging is crucial since it guarantees that items arrive safely.

Africa and the Middle East Low supply and narrowing profit margins triggered a major transformation in the Middle East packaging industry, allowing manufacturers and suppliers to employ innovative and unique packaging to boost sales. As a result of high job levels and a healthy economy, the Middle East's purchasing power has increased, boosting demand for packaging throughout the region. E-commerce has already established itself as a significant sales channel for a wide range of products in the Middle east and north Africa, from food and beverages to consumer electronics and home and beauty care. Furthermore, the surge in online sales has supported the growth of the market for solid board packaging solutions, as these solutions allow sellers to ensure the safe delivery of their products sold online.

Key Companies Insights

Companies are engaged in various strategies, such as mergers &acquisitions, product launches, partnerships, and joint ventures to gain a greater market share. In August 2021 Mayr-Melnhof Group has finalized the previously announced purchase of International Paper's Kwidzyn pulp and paper factory and supporting activities. On four machines, the Kwidzyn Company employs around 2,300 people and produces 740,000 metric tonnes of folding boxboard, uncoated freshet, specialized kraft papers, and market pulp annually. With manufacturing sites in North America, Latin America, Europe, North Africa, and Russia, International Paper is a prominent global manufacturer of sustainable fiber-based packaging, pulp, and paper goods.

- International Paper

- Smurfit Kappa Group

- VPK Packaging Group NV

- Mugler Masterpack Crimmitschau GmbH

- Sappi Ltd

- Brodrene Hartmann A/S

- DS Smith PLC

- Huhtamaki Oyj

- AR Packaging Group AB

- BillerudKorsnas AB

- Reynolds Group Holdings Limited

- Sonoco Products Company

- Stora Enso Oyj

- International Paper Company

- KapStone Paper and Packaging Corporation

- Mayr-Melnhof Karton AG

- Mondi Ltd.

- Pratt Industries, Inc.

- Rengo Co., Ltd.

| Report Attribute | Details |

| Market size value in 2020 | USD 9.1 billion |

| Revenue forecast in 2030 | USD 15 billion |

| Growth Rate | CAGR of 5% from 2021 to 2030 |

| Base year for estimation | 2019 |

| Historical data | 2016 - 2019 |

| Forecast period | 2020 - 2030 |

| Quantitative units | Revenue in USD million and CAGR from 2020 to 2030 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Material Insights (Virgin Material, Recycled Material), By Application Insights (Boxes, POP Displays Edge Protectors, Trays, and Layer Pads.), By End Use Insights (Chemicals, Food & Beverages, Consumer electronics, Construction, Others) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; South Korea; Brazil; Mexico; South Africa; Saudi Arabia; UAE |

| Key companies profiled | International Paper, Smurfit Kappa Group, VPK Packaging Group NV, Mugler Masterpack Crimmitschau GmbH, Sappi Ltd, Brodrene Hartmann A/S, DS Smith PLC, Huhtamaki Oyj, AR Packaging Group AB, BillerudKorsnas AB, Reynolds Group Holdings Limited, Sonoco Products Company, Stora Enso Oyj, International Paper Company, KapStone Paper and Packaging Corporation, Mayr-Melnhof Karton AG, Mondi Ltd., Pratt Industries, Inc., Rengo Co., Ltd. |