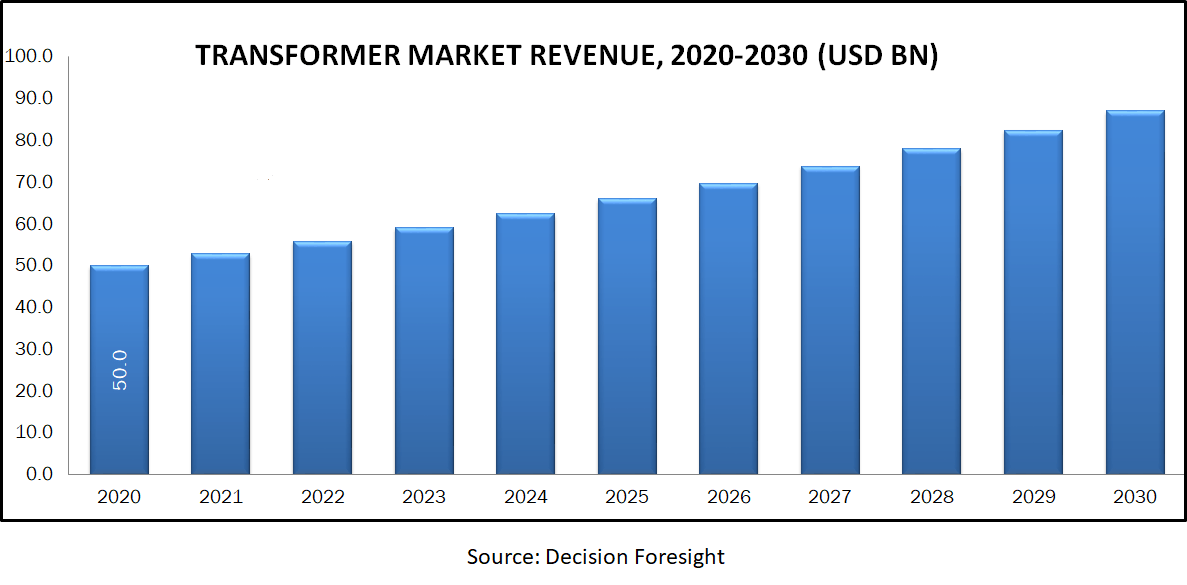

Transformer Market size was valued at USD 50 billion in 2020, and is expected to reach USD 87.0 billion by 2030, registering a CAGR of 5.70% from 2020 to 2030. A transformer is a static machine used in the transmission and distribution of electrical power. It helps in the transmission of power from one network to the other without any change in frequency. In other words, transformers are used to either step-up or step-down the voltage, keeping the frequency constant, in order to achieve better transmission efficiency and minimize losses. Transformers are also used to create an isolation between two electric circuits. They consist of mainly two parts – core and windings, and work on the principle of mutual induction.

Market Segmentation:

On the basis of product type, the market is classified into power transformer, distribution transformer, and instrument transformer. Based on structure, the market can be bifurcated into core-type and shell-type transformers. According to winding type, the market is segregated into two-winding transformer and autotransformer. Based on type of installation, the market is divided into indoor and outdoor transformers. By rating means, the market is categorized into three types mainly <=10 MVA, 11-60MVA, and >600MVA. According to mounting type, the market can be classified into pad, pole, and PC/PCB mounted transformers. Based on the type of cooling, the market is divided into dry type and oil immersed transformers. Dry type cooling includes self-air and air blast cooling, whereas oil immersed cooling constitutes of self-cooled, water cooled, and forced oil cooled transformers. By insulation type, the market is segmented into gas, oil, air, and solid insulation transformers. According to applications, the market is classified into residential usage, commercial usage, and industrial usage. Geographically, the market can be broadly divided into five regions mainly North America, Europe, Asia Pacific, and RoW.

Market Dynamics and Factors:

Rapid industrialization and urbanization have increased the demand and consumption of electricity across the globe. Increasing number of commercial and industrial establishments together with the increasing use of electrical appliances are driving the global demand for electricity. Factors such as upgradation of power and distribution infrastructure, replacement of equipment at the end of their service life, development of heavy industries and increasing focus on renewable energy generation are other major factors driving the market globally. For instance, in 2018, the European Commission announced that the European nations will experience an increase in renewable energy share to 34% in 2030 when compared to 17% in 2015. However, stress causing failures and operational inefficiencies, attributing to delays and suspensions, are the major factors restraining of the transformer market growth.

Geographic Analysis:

Asia Pacific region dominates the market in terms of market share during the forecast period followed by North America. Increasing investments in the transmission and distribution networks in APAC countries, such as India and China has provided tremendous growth opportunities for the distribution transformer manufacturers to increase their share in the market, during the forecast period. For instance, in Asia-Pacific, according to BP Statistics 2019, total electrical power generated in 2018 was around 12273.6 terawatts, while the overall consumption was less. This leads to higher demand for distribution transformer infrastructure to bridge the gap between supply and demand. MEA region is anticipated to witness the fastest growth in the market during the forecast period. Countries in the Middle-East region, such as Oman and Saudi Arabia, are also investing in the expansion and restructuring of distribution power grids, which increases the growth prospects of the market.

Competitive Scenario:

The key players operating in the global transformer industry are –

Siemens, ABB, Schneider, BHEL, GE, Toshiba, Mitsubishi, Kirloskar, Eaton, Hyundai, and Crompton Greaves.

Transformer Market Report Scope

| Report Attribute | Details |

| Market size value in 2020 | USD 50 billion |

| Growth Rate | CAGR of 5.7% from 2021 to 2030 |

| Forecast period | 2021 - 2030 |

| Quantitative units | Revenue in USD billion 2020 to 2030 and CAGR from 2021 to 2030 |

| Report coverage | Revenue forecast, Market Share Analysis, Sales Analysis, Competitor Analysis, Growth factors, and trends, Macro-economic indicator analysis, PORTER's Five Forces analysis, Pricing Analysis, PESTEL Analysis, Value Chain Analysis, COVID-19 Impact Analysis |

| Segments covered | By Product Type (Power Transformer, Distribution Transformer, Instrument Transformer), By Structure (Core-Type And Shell Type), By Winding (Two-Winding and Autotransformer), By Installation Type (Outdoor And Indoor), By Phase (Single Phase And Three Phase), By Rating (<=10 Mva, 11-60mva, 61-600mva, and >600 Mva), By Mounting (Pad, Pole, Pc/Pcb), By Cooling Type (Dry Type {Self Air and Air Blast}, By Oil Immersed {Self Cooled, Water Cooled, Forced Oil}) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Country scope | U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Japan; China; India; Malaysia; Singapore; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Turkey |

| Key companies profiled | o Siemens o ABB o Schneider o BHEL o GE o Toshiba o Mitsubishi o Kirloskar o Eaton o Hyundai o Crompton Greaves |